- TRX maintaining its support will attract price recoveries.

- The price touched a crucial 24hr bearish order block.

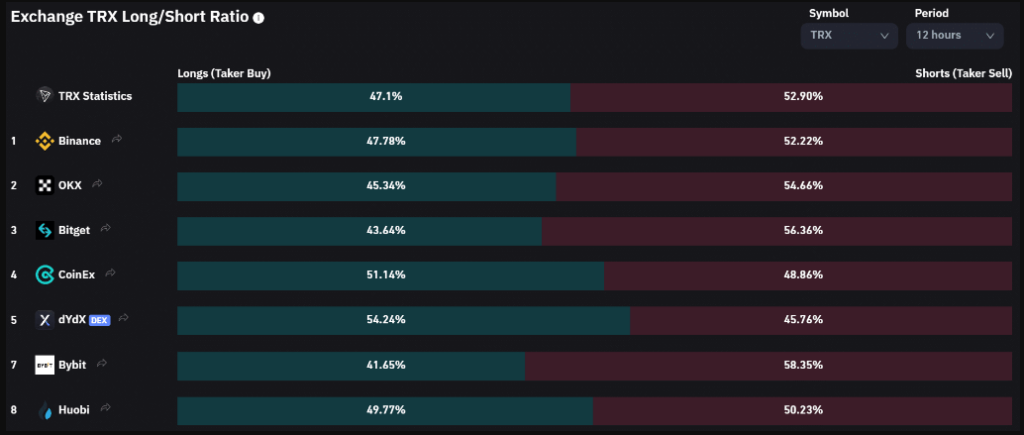

- The exchange short-long ratio favored Tron sellers.

Tron (TRX) recorded impressive demand on April 26 after touching a vital demand territory and a bullish block near $0.06400. That saw the alternative token rallying toward a crucial resistance and bearish order block at around $0.06800. Nonetheless, sellers flexed their muscles during this writing, showing that TRX bulls might encounter challenges overpowering the price ceiling.

Recent data showed TRX’s precarious state as development activity and sentiment dipped. Considering the $0.06800 price ceiling, the altcoin might endure downward momentum unless Bitcoin reclaims the $30K territory.

Extended Pullback?

Source – TradingView

The $0.06800 bearish block has represented a local ceiling over the last two months – March & April. Previous rejection at the hurdle triggered declines that stretched to the ascending resistance or demand region near $0.06500.

While publishing this post, TRX’s price action touched the ceiling, and sellers seemed ready to drop the price. Thus, the alt might fall to the support and bullish block at $0.06400. Meanwhile, retesting the confluence support might welcome new buying opportunities with a lucrative risk ratio – especially if the alt rebounds to the mentioned ceiling.

A closing beyond the $0.06903 hurdle and subsequent upticks will cancel the above narrative. Such upswings will see bulls targeting $0.07200. However, they should overcome the resistance at $0.07044.

The Relative Strength Index encountered rejection at 60 during this publication, reflecting eased buying momentum. Moreover, the On Balance Volume maintained lower lows since April 1 – confirming restricted demand for Tron (in that timeframe).

Speculator on TRX

Source – Coinglass

Coinglass data shows shorts dominated the Tron market at 52.9% over longs within the last twelve hours. It indicates that most speculators maintained bearishness on the alt in the mid-long term.

Meanwhile, Tron’s funding rate swayed over the past few days as funding rates stayed somewhat negative since April 30. That might trigger more downward momentum on TRX. However, Bitcoin’s move past $30K will discourage sellers and welcome upsides in TRX price.