- CryptoQuant data shows miners continue reducing Bitcoin reserves.

- Miners holding Bitcoins longer could positively impact the market.

- Keep an eye on miners’ reserve trends in the coming days.

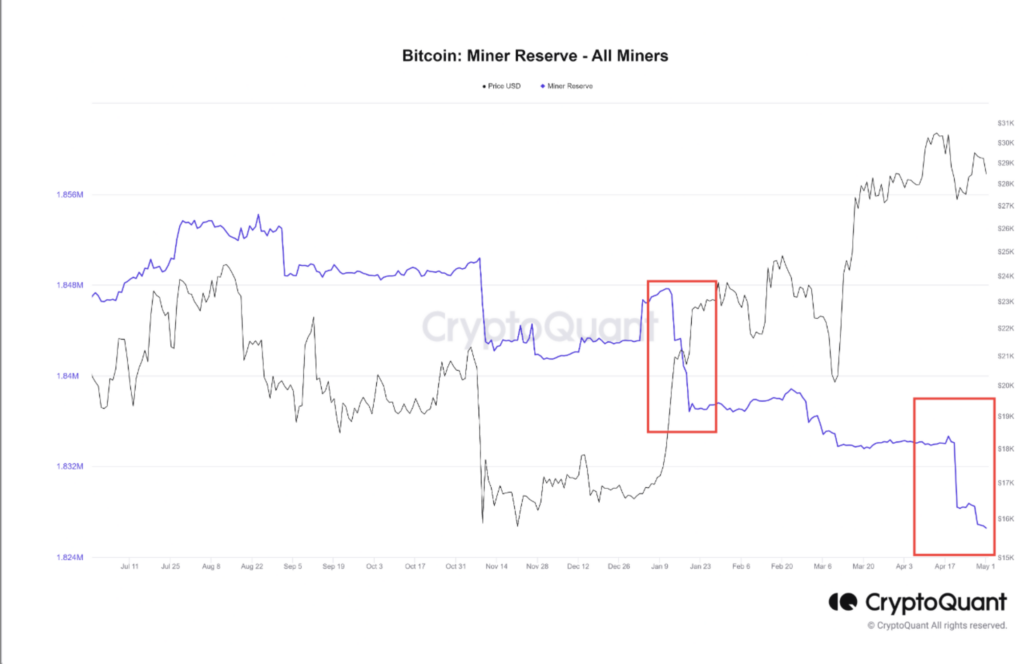

CryptoQuant data reveals that the bear market for miners is far from over as they continue to reduce their Bitcoin reserves despite recent market fluctuations.

Read CRYPTONEWSLAND onAccording to the analytics platform, miners have been decreasing their Bitcoin holdings even as the market experiences growth. The return of miners’ interest in holding Bitcoins for an extended period could be a valuable factor in driving price growth. However, it seems that miners are not yet convinced that the market has entered a new bullish phase.

As the market evolves, it is crucial to monitor the trends in miners’ reserves closely. If miners start to show increased interest in holding onto their Bitcoins, it could signal a potential shift in the market sentiment and pave the way for more sustainable growth. For now, the bear market for miners persists, and the ongoing reduction in Bitcoin reserves, as indicated by CryptoQuant data, remains a concern for investors and analysts alike.

Recommended News :

disclaimer read moreCrypto News Land (cryptonewsland.com) , also abbreviated as “CNL”, is an independent media entity — we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.