- Michael Saylor’s bullish stance on Bitcoin since 2020 has positioned him for substantial gains.

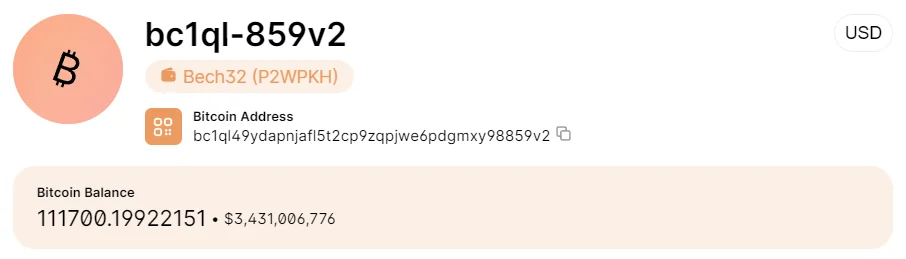

- MicroStrategy, under Saylor’s leadership, has accumulated a significant Bitcoin holding of 138,955 BTC at an average buy price of $29,817.

- If approved, Bitcoin ETFs have the potential to fuel Saylor’s Bitcoin bet, potentially elevating him to one of the wealthiest individuals globally.

Michael Saylor, the CEO of MicroStrategy, has attracted attention with his bold and unwavering belief in Bitcoin. Since 2020, Saylor has been on a strategic journey, accumulating a significant amount of Bitcoin for his company. This calculated bet on the world’s leading cryptocurrency has the potential to propel him to unprecedented wealth if recent speculations around Bitcoin ETF approvals materialize.

Saylor’s interest in Bitcoin stemmed from concerns over inflation and the devaluation of traditional fiat currencies. Fearing the impact of inflation on MicroStrategy’s cash reserves, he sought a more reliable store of value, ultimately leading him to Bitcoin. With conviction in its long-term potential, Saylor made a series of significant purchases, accumulating a total of 138,955 BTC for MicroStrategy.

As of now, MicroStrategy’s average buy price for Bitcoin stands at $29,817, putting the company in a profitable position as the cryptocurrency’s value has appreciated over time. Saylor’s strategic move to allocate a substantial portion of the company’s treasury to Bitcoin has garnered attention within the financial community and raised the possibility of a remarkable payoff.

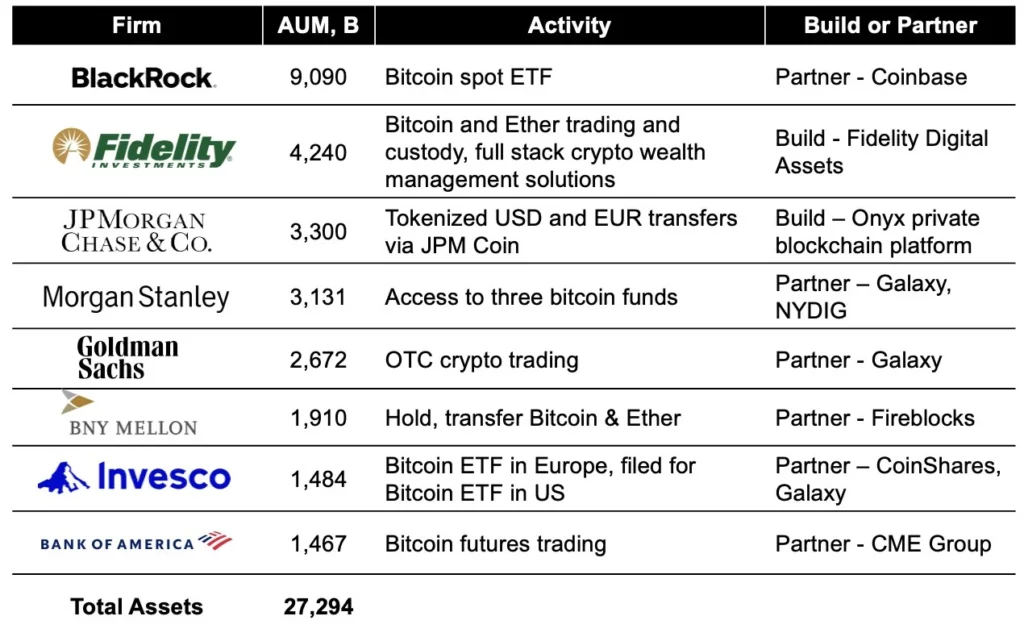

The potential approval of Bitcoin exchange-traded funds (ETFs) adds another layer of excitement to Saylor’s bet. If ETFs are approved and institutional investors gain easier access to Bitcoin, the resulting demand could significantly drive up the price. This surge in value would not only secure MicroStrategy’s position but also position Saylor as one of the wealthiest individuals globally.

However, the outcome of Saylor’s Bitcoin bet remains uncertain. While Bitcoin has experienced remarkable growth and gained mainstream acceptance, the cryptocurrency market remains volatile and subject to regulatory changes. The success of Saylor’s investment hinges on various factors, including market dynamics and broader adoption of Bitcoin.

Regardless of the outcome, Saylor’s conviction and audacious approach to Bitcoin have captivated the crypto community. His unwavering belief in the potential of digital assets and his strategic actions have positioned him as a prominent figure in the cryptocurrency space.

As investors and enthusiasts eagerly await the decision on Bitcoin ETF approvals, the implications for Saylor’s bet and the broader crypto market are significant. If ETFs are greenlit, it could mark a milestone in the maturation and mainstream adoption of Bitcoin as a legitimate asset class.

In conclusion, Michael Saylor’s bet on Bitcoin has positioned him for immense potential wealth. His strategic accumulation of Bitcoin within MicroStrategy demonstrates his confidence in the long-term prospects of the cryptocurrency. With the possibility of ETF approvals on the horizon, Saylor’s vision and foresight may well pave the way for a prosperous future, not only for him but for the broader cryptocurrency ecosystem.

Recommended News :