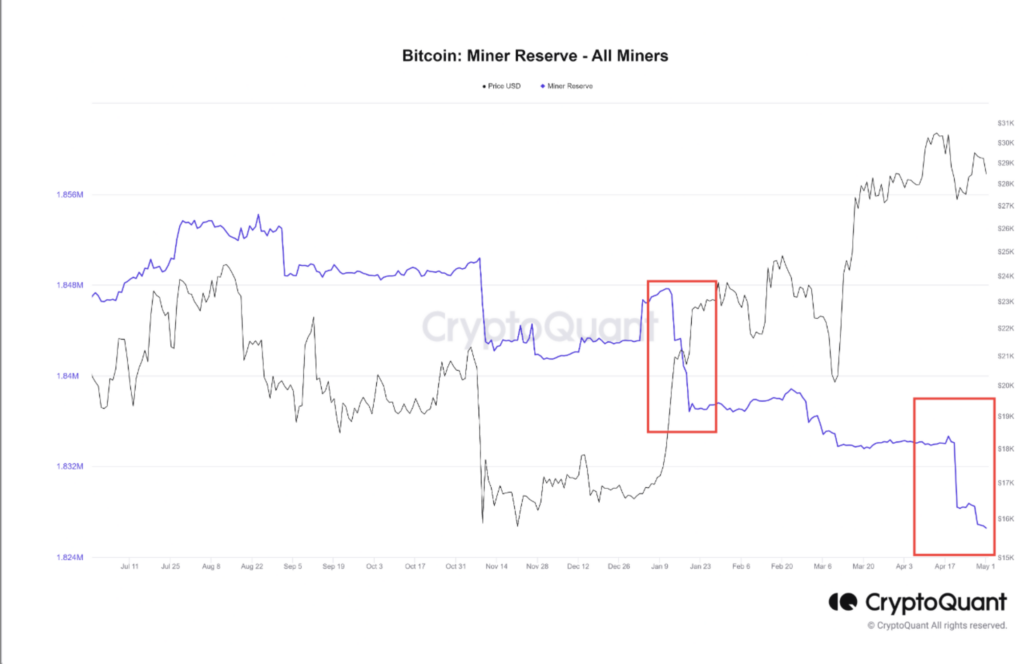

- CryptoQuant data shows miners continue reducing Bitcoin reserves.

- Miners holding Bitcoins longer could positively impact the market.

- Keep an eye on miners’ reserve trends in the coming days.

CryptoQuant data reveals that the bear market for miners is far from over as they continue to reduce their Bitcoin reserves despite recent market fluctuations.

According to the analytics platform, miners have been decreasing their Bitcoin holdings even as the market experiences growth. The return of miners’ interest in holding Bitcoins for an extended period could be a valuable factor in driving price growth. However, it seems that miners are not yet convinced that the market has entered a new bullish phase.

As the market evolves, it is crucial to monitor the trends in miners’ reserves closely. If miners start to show increased interest in holding onto their Bitcoins, it could signal a potential shift in the market sentiment and pave the way for more sustainable growth. For now, the bear market for miners persists, and the ongoing reduction in Bitcoin reserves, as indicated by CryptoQuant data, remains a concern for investors and analysts alike.