- Bitcoin RSI has inspired various suggestions from crypto analysts.

- In the last 24 hours, Bitcoin was almost overbought.

- An RSI indicates whether an asset is overbought or oversold.

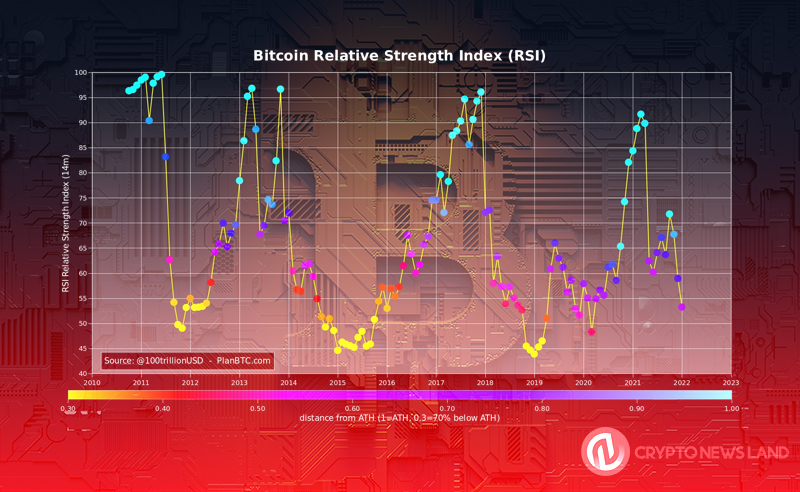

Bitcoin’s Relative Strength Index (RSI) recently became a hot topic in the crypto space. This was when price analysts Lark Davis and PlanB mentioned Bitcoin’s interesting movement in terms of the mentioned price indicator.

Davis noted that in the 1-day chart, Bitcoin saw a similar trend in which it bounced back by +130% after hitting a prolonged downtrend in RSI. He said that Bitcoin’s RSI is in the same pattern at the moment.

Meanwhile, PlanB, the one who made the Stock-to-Flow (S2F) price model, said that Bitcoin could either have a bullish reversal or a bearish nosedive soon.

However, Bitcoin’s current price movement is showing some bullish strength manifesting. In fact, the price has briefly touched the $38,700 price mark in the last 24 hours. Also, Bitcoin price is currently trading at $38,379.31, which is a 1.6% daily increase, according to CoinGecko.

Read CRYPTONEWSLAND onMeanwhile, Bitcoin price has barely hit the RSI value of 70. Specifically, this means that Bitcoin was close to being overbought in the last 24 hours. This also shows that buying interest has surged among investors and traders.

In various financial markets, many consider the RSI as a strong indicator of potential rallies, especially if backed with other trends and indicators. The RSI indicates whether an asset is overbought or oversold.

Recommended News :

disclaimer read moreCrypto News Land, also abbreviated as "CNL", is an independent media entity - we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.