- Exchange reserves of Bitcoin are declining, signaling a shift towards long-term hodling.

- Historical data suggests a correlation between decreasing deposit transactions and bullish market sentiment.

- The growing hodling trend reflects investor confidence and anticipation of future Bitcoin price increases.

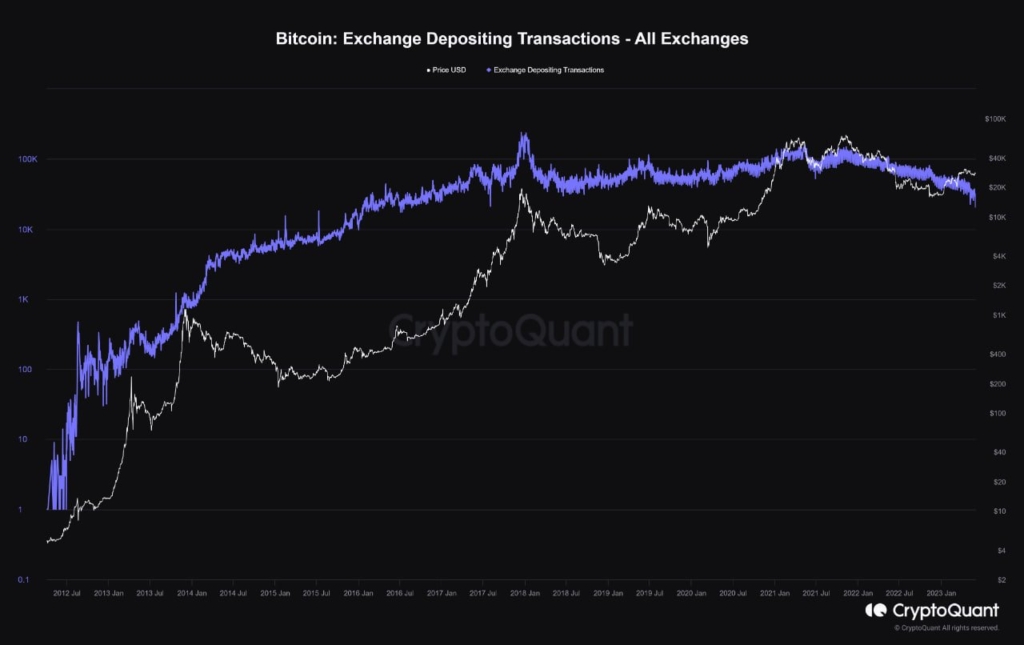

In May 2023, the Bitcoin market witnesses a significant shift in investor sentiment. Exchange reserves are declining, indicating a strengthening hodling trend among investors. This trend suggests a shift towards long-term investment strategies and a decreased inclination for active trading.

Read CRYPTONEWSLAND onAnalysts closely monitor the decrease in Bitcoin held on exchanges, indicating a preference for hodling over short-term trading. This aligns with historical data, which shows a correlation between decreasing deposit transactions and bullish market sentiment.

The declining deposits during price increases suggest investor anticipation of bullish momentum before halving events and reinforce the belief in the potential value appreciation of Bitcoin. This growing hodling trend reflects investor confidence in the long-term prospects of Bitcoin.

Investors are positioning themselves for potential future price increases, believing in the digital asset’s store of value proposition. The hodling behavior signifies a shift in mindset, prioritizing long-term gains over short-term trading profits.

As exchange reserves decline, investors continue to hold onto their Bitcoin holdings. This behavior stems from the belief in Bitcoin’s appreciation potential and the desire to maximize financial gains in the long run. The growing hodling trend contributes to the stability of Bitcoin’s market and its overall maturity as a digital asset.

The declining exchange reserves highlight the growing hodling trend and reinforce investors’ confidence in the future value of Bitcoin. Investors perceive the digital asset as a viable long-term investment, positioning themselves for potential price surges and overall market growth.

In conclusion, the hodling trend strengthens as Bitcoin’s exchange reserves decline. This trend signifies a shift towards long-term investment strategies, reflecting investor confidence and belief in the digital asset’s long-term value proposition. The declining reserves contribute to market stability and growth, further solidifying Bitcoin’s position as a leading digital asset in the crypto market.

Recommended News :

disclaimer read moreCrypto News Land (cryptonewsland.com) , also abbreviated as “CNL”, is an independent media entity — we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.