- XRP failed to hold its ground above the VWAP bands and dropped back to the critical price of $2.20.

- The 2.20 level is very crucial in determining whether it gets future support or declines further.

- The performance of Bitcoin is most likely to directly affect XRP’s price action going forward from that of $2.20.

Having closely watched the VWAP bands, it has certainly just put considerable pressure on XRP lately as it dragged back down to around $2.20. The major level of support Ghana has broken to maintain the bullish momentum was previously attempted to be held above these bands by the price.

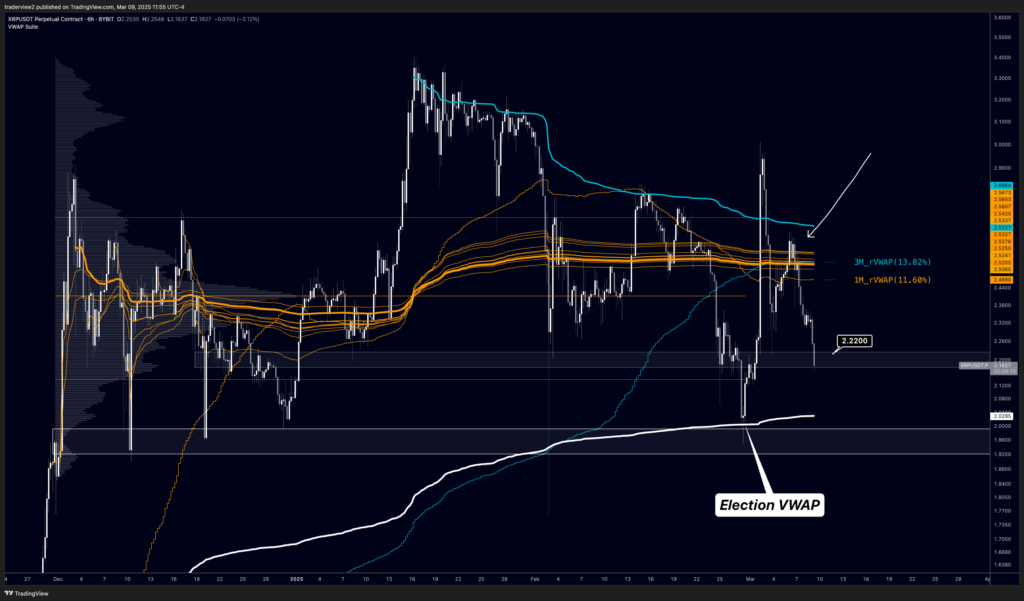

With the chart accompanying the data on March 9, 2025, by analyst Dom (@traderview2), the market has gained entry into a very critical test zone having the $2.20 level as a very important line of defense. It has exhibited some response historically at this level, and the next few hours will be vital in deciding if XRP will indeed hold this support and thus push itself up.

VWAP Bands: Keys Levels That Bulls Couldn’t Hold

The chart illustrates how XRP has failed to maintain above the VWAP bands, specifically the orange lines representing the 3-month and 1-month VWAP. These bands are important in identifying the average price weighted by volume of a given period, and their failure to hold is synonymous with the moment when bulls have lost some grip on the market.

The 3-month VWAP is at 13.82% while the 1-month VWAP rests at 11.6%, showing how price could not maintain enough strength to hold above these very important levels. As XRP traced back down to $2.20, traders now watch whether that zone can react and supply sufficient support for the next move.

Election VWAP and How It Creates Conditions for XRP’s Current Situation

Across the price action, the added complication for XRP is coming from Election VWAP, which Dom has indicated on his chart. This is the only VWAP that has been accommodated to follow price action around key election-related market events, and it looks like it would have been a significant guide toward where price is heading as it dives lower to $2.20.

However, it becomes much more critical for traders-the psychological zone boundary coinciding with the Election VWAP further consolidates it as an important level for them. This combination of indicators has both the possibility for rising and falling, depending on how the market reacts in the next few hours.