- US government holds 205,500 BTC worth $6 billion.

- Assets acquired from Bitfinex hack and Silk Road.

- US ranks among the largest Bitcoin holders globally.

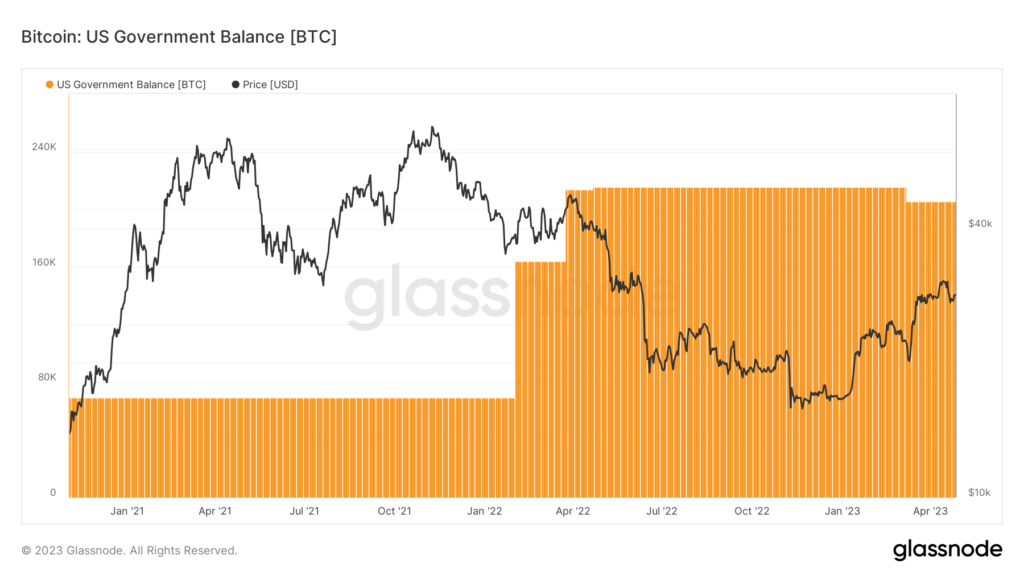

The US government has emerged as one of the largest Bitcoin holders in the world, currently holding 205,500 BTC worth approximately $6 billion. This substantial holding is a result of assets seized from the infamous Bitfinex hack and Silk Road marketplace.

The Bitfinex hack, which occurred in 2016, saw the theft of 120,000 BTC, while the Silk Road, an infamous online black market, was shut down in 2013, resulting in the seizure of thousands of Bitcoins. These combined events have led the US government to amass a significant portion of the world’s Bitcoin supply.

This revelation underscores the growing importance of cryptocurrencies in the global financial landscape. It also highlights the need for regulatory clarity around the use and storage of digital assets. As more governments and institutions recognize the potential of cryptocurrencies, it is likely that regulations will continue to evolve to keep pace with this rapidly changing industry.

The US government’s position as a major Bitcoin holder also raises questions about its potential influence on the market. With such a large stake, any decisions made by the US government regarding the management or sale of these assets could have significant implications for the price of Bitcoin and the wider cryptocurrency market.

As governments worldwide continue to grapple with the rise of cryptocurrencies, it remains to be seen how they will manage their holdings and the potential impact on the market. Will the US government use its Bitcoin holdings strategically, or will it eventually liquidate them? The crypto community will be closely watching for any developments in this space.

In the meantime, the fact that the US government is one of the largest Bitcoin holders highlights the growing mainstream acceptance of cryptocurrencies. As the market continues to mature, it is expected that more institutional investors will follow suit, further solidifying the role of digital assets in the global economy.