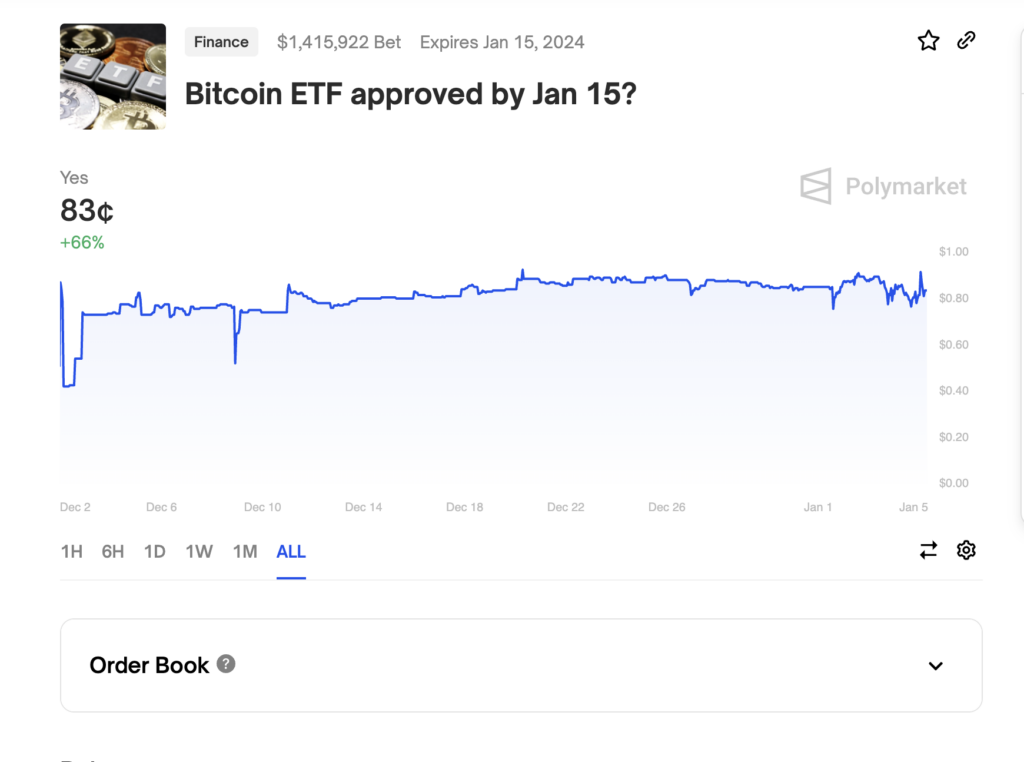

- A trader places a significant bet of $379,000 on Bitcoin ETF approval.

- The bet reflects an 80% confidence level in the ETF’s regulatory approval.

- This move underscores the high stakes and speculation surrounding Bitcoin ETFs.

In a striking display of confidence in the cryptocurrency market, a trader has placed a substantial bet of $379,000 on the approval of a Bitcoin Exchange-Traded Fund (ETF). This wager, based on an 80% probability of approval, highlights the high stakes and intense speculation surrounding the regulatory developments of Bitcoin ETFs.

Read CRYPTONEWSLAND on

This bold move by the trader reflects a significant level of optimism regarding the SEC’s impending decision on Bitcoin ETFs. The 80% odds suggest a strong belief that the regulatory environment is favorable for the approval of these financial products. Bitcoin ETFs have been a topic of much discussion in the crypto community, with many seeing their approval as a milestone that could lead to wider acceptance and integration of Bitcoin into mainstream finance.

The sizable amount of the bet indicates the trader’s confidence in the outcome, as well as the high level of interest and potential financial implications surrounding the approval of Bitcoin ETFs. It is a noteworthy example of the kind of speculative investments that are often seen in the cryptocurrency market, known for its volatility and rapid changes.

However, it’s important to note that such bets carry significant risk, given the unpredictable nature of regulatory decisions and the complexities involved in the approval process of new financial products, especially in the evolving landscape of digital currencies.

The anticipation around the approval of Bitcoin ETFs reflects the broader sentiment in the cryptocurrency market, where regulatory developments are closely watched and can have substantial impacts on market dynamics. The outcome of this bet, and the SEC’s decision on Bitcoin ETFs, will be closely monitored by investors and market observers alike.

This situation underscores the dynamic and speculative nature of the cryptocurrency market, where regulatory developments can open up new opportunities for investors but also carry considerable risks.

Recommended News :

disclaimer read moreCrypto News Land (cryptonewsland.com) , also abbreviated as “CNL”, is an independent media entity — we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.