- Monero: Privacy-focused demand stays steady through strong anonymity and censorship resistance.

- Stellar: Fast, low-cost payments keep network usage consistent across global remittance markets.

- VeChain: Enterprise adoption grows through supply chain tracking and real-world blockchain applications.

Capital movement across the crypto market continues to reveal a clear shift in priorities. Investors appear more selective, directing funds toward projects with visible use cases and steady demand. Speculative narratives no longer dominate attention as strongly as before. Instead, many market participants focus on networks that function reliably during both active and quiet periods. Privacy protection, efficient payments, and enterprise adoption now attract sustained interest. These areas offer practical value rather than short-term excitement. This trend explains why certain established cryptocurrencies remain closely monitored. Monero, Stellar, and VeChain reflect this rotation toward purpose-driven blockchain projects.

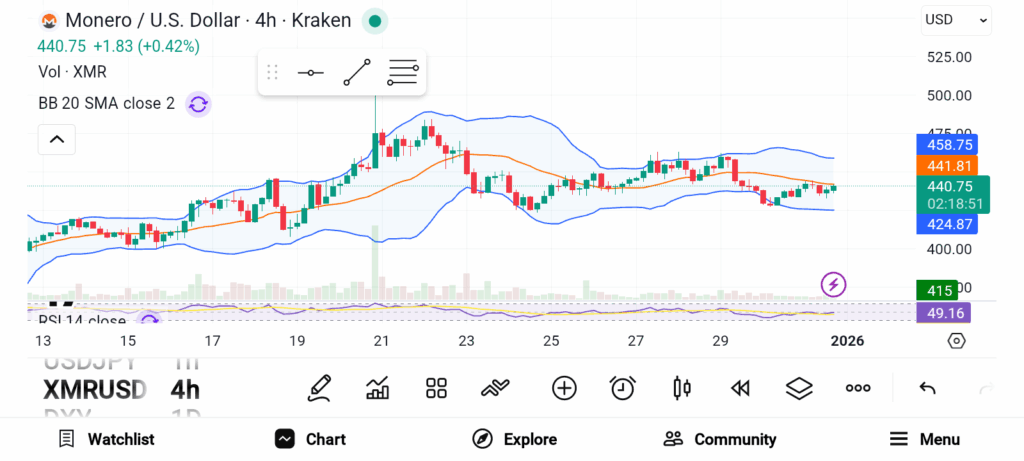

Monero (XMR)

Monero holds a unique position as a privacy-first cryptocurrency with consistent real-world usage. The network uses advanced cryptographic methods to protect transaction details and user identity. This design supports confidential financial activity and censorship resistance across different regions. Demand for privacy remains steady, especially as digital surveillance continues expanding globally.

Monero rarely depends on online hype to maintain relevance. A committed community supports development and adoption across market cycles. Updates focus on security, efficiency, and resilience rather than promotional efforts. Investors seeking utility-driven assets often regard XMR as the standard within the privacy segment. That reputation helps sustain long-term confidence and ongoing demand.

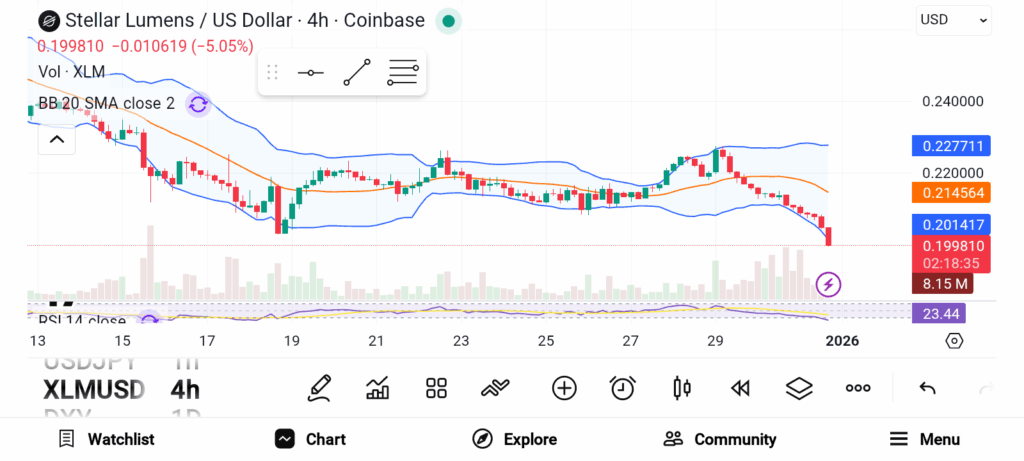

Stellar (XLM)

Stellar continues building a strong presence within blockchain-based payment solutions. The network prioritizes fast settlement times and minimal transaction costs. This structure benefits cross-border transfers and remittance services. Financial platforms operating in emerging markets often favor these features. Over time, Stellar has developed partnerships with payment providers and fintech companies.

These integrations support consistent network usage rather than speculative trading. Growth aligns with real financial needs rather than trend-driven interest. XLM remains accessible due to a relatively low price range. Investors tracking functional payment networks often include Stellar on watchlists for long-term relevance.

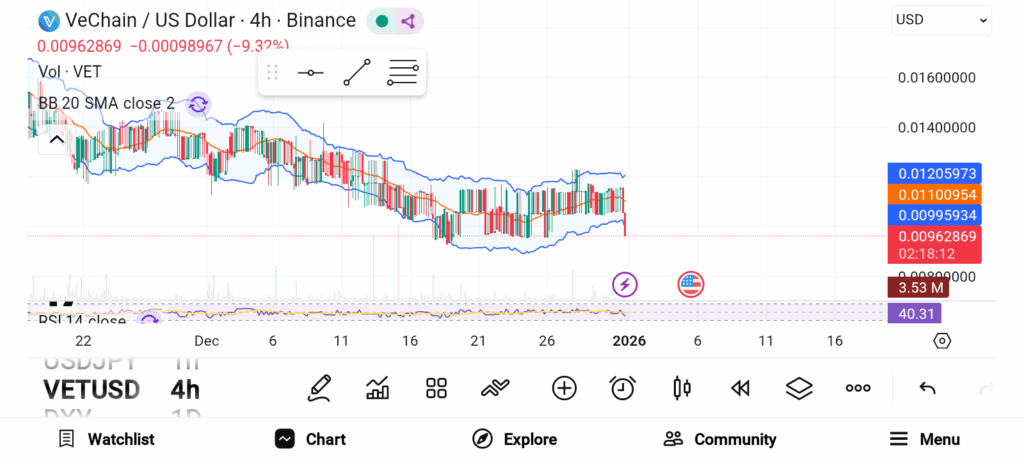

VeChain (VET)

VeChain distinguishes itself through enterprise-focused blockchain applications. Supply chain tracking, product authentication, and data verification form the core mission. Businesses use the network to improve transparency and operational efficiency. Long-term corporate partnerships support sustained adoption beyond retail interest.

Real-world pilots strengthen credibility during slower market periods. As industries increasingly adopt blockchain solutions, demand for traceability continues growing. VeChain benefits from this gradual expansion. Development prioritizes reliability and practical integration. Investors focused on adoption metrics often view VET as a durable project with real business relevance.

Capital rotation highlights growing interest in functional blockchain projects. Monero addresses privacy needs, Stellar supports global payments, and VeChain serves enterprise adoption. Each network delivers measurable utility beyond market narratives. This focus explains continued investor attention toward these established cryptocurrencies.