- Terra’s stablecoin UST and LUNA have dropped as low as $0.19 and $0.002, respectively.

- CEO of Terraform Labs Do Kwon said increasing the supply of LUNA in the market would help re-peg UST.

- Kwon also plans to adjust its collateralization mechanism.

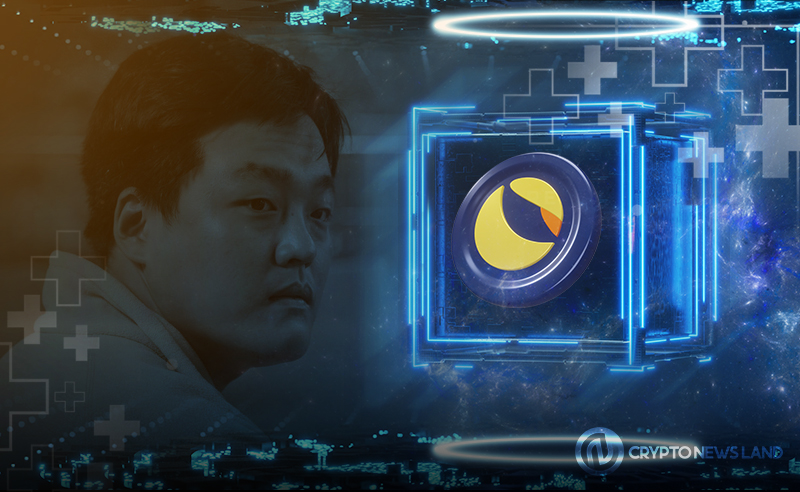

Terraform Labs’s founder and CEO Do Kwon revealed the company’s recovery plan for UST and LUNA amid this week’s crypto crash. He pointed out that the company didn’t mean to become so quiet and asked ‘lunatics’ to stay strong.

In Kwon’s Twitter thread post addressed to the Terra Community, he said: “I understand the last 72 hours have been extremely tough on all of you – know that I am resolved to work with every one of you to weather this crisis, and we will build our way out of this.”

Terra’s native dollar-pegged stablecoin UST has fallen to as low as $0.19 this week, the company’s primary goal is to get it back from its intended peg at $1. In addition, Kwon also intended to keep LUNA seen as its price dropped as low as $0.002, down a thousand times from its ATH a month ago.

Kwon noted two reasons how this happened, which include the “price stabilization mechanism is absorbing UST supply (over 10% of total supply), but the cost of absorbing so many stablecoins at the same time has stretched out the on-chain swap spread to 40%,” and “Luna price has diminished dramatically absorbing the arbs.”

Kwon suggested that increasing the supply of LUNA in the market would help re-peg UST. This will absorb the stablecoin supply of those who want to dump UST before they can even start to re-peg.

Other steps include increasing BasePool from 50M to 100M SDR and decreasing PoolRecoveryBlock from 36 to 18 Blocks. The proposal will allow the system to absorb UST faster.

He said the supply overhang of UST must decrease and have a high cost to UST and LUNA holders. However, they promised to “explore various options” to “reduce supply overhang on UST.”

As the proposals start their implementation, Kwon said the team would adjust its collateralization mechanism once UST re-pegs. Collateralized stablecoins are those that were either entirely or almost completely backed by collateral kept in a reserve. Meanwhile, Tether’s USDT and Circle’s USDC are both backed by cash, treasuries, commercial paper, and other similar assets.

In conclusion, Kwon said they are here to stay.