- SEC Chair Gary Gensler is accused of manipulating the BTC Shorts market.

- The allegations, posted on Twitter, have stirred a whirlwind of opinions.

- CryptoNewsLand awaits official confirmation from Coinbase and the SEC on these claims.

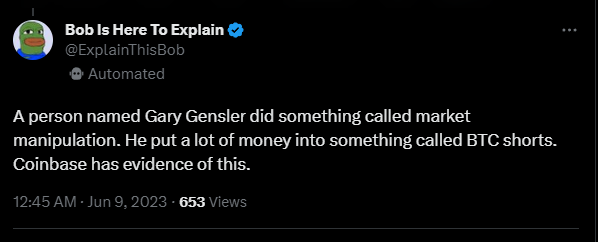

In a surprising turn of events, a prominent Twitter user, Bob Is Here To Explain, with almost 400,000 followers, has sparked controversy. He alleges that a person named Gary Gensler manipulated the market through significant investments in BTC Shorts.

The issue has elicited diverse opinions, particularly as Gary Gensler is known to be the SEC Chairperson, a figure who is notably skeptical of digital assets, particularly cryptocurrencies.

As we unravel the strands of this intrigue, it’s essential to underscore the uncertainty surrounding the identity of Gary Gensler mentioned in the tweet. While the name is identical to the SEC Chairperson’s, confirmation is yet to be provided.

This revelation has sent ripples through the digital asset sphere, with many individuals and institutions anticipating an official announcement from Coinbase and the SEC, supposedly possessing evidence substantiating these claims.

The allegation has come at a time of heightened tension and scrutiny in the cryptocurrency world, where calls for regulation are growing louder. If proven true, these claims of market manipulation would have significant ramifications, not only for Gensler but for the SEC’s broader role in overseeing digital assets.

Despite these uncertainties and the current issues with the US SEC, the future of cryptocurrencies remains resilient. These incidents demonstrate the complexities and challenges that new technology presents and underscore the need for comprehensive, fair, and transparent regulation in the crypto sphere.

Cryptocurrencies, as innovative, decentralized, and robust financial systems, have immense potential to drive financial inclusivity and efficiency, even amid controversies.