- Dogecoin benefits from strong branding, community support, and payment adoption.

- Cardano offers smart contracts, staking rewards, and long term development focus.

- Bitcoin Cash targets fast, low fee digital payments for everyday use.

The crypto market never stands still. Smart investors plan before momentum returns. The next cycle could reward strong altcoins with real use. Some projects already built loyal communities and solid networks. Others focus on speed and lower fees. If you want exposure beyond Bitcoin, three names deserve attention in 2026. Let’s break down why Dogecoin, Cardano, and Bitcoin Cash could offer upside.

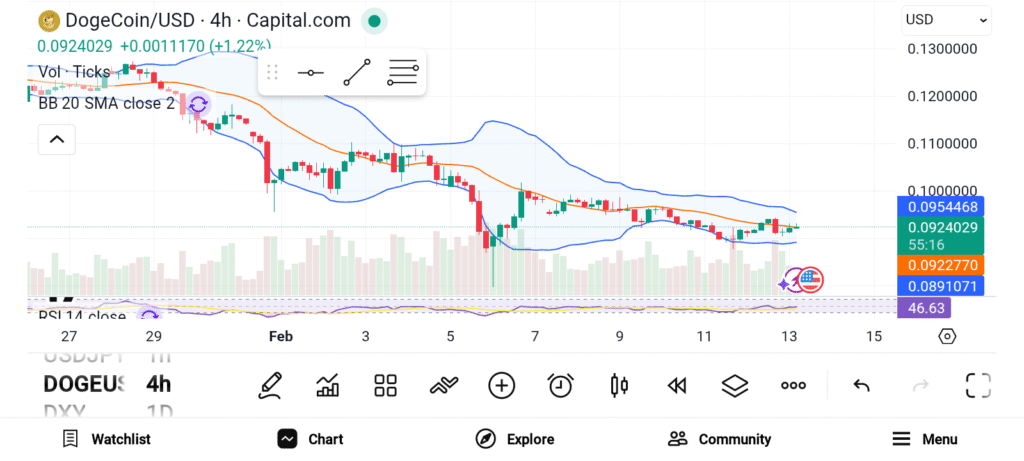

Dogecoin (DOGE)

Dogecoin began in 2013 as a lighthearted experiment. Billy Markus created the coin to add humor to crypto. What started as satire grew into a global brand. Today, DOGE ranks among the largest cryptocurrencies by market value. DOGE runs on code similar to Bitcoin and Litecoin. Developers forked open source code to launch the network. Unlike Bitcoin, DOGE has no supply cap. New coins enter circulation on a steady schedule. Blocks confirm faster than Bitcoin. That design supports quick transfers. Many users treat DOGE as a payment coin. The 2021 bull run pushed prices sharply higher. Elon Musk promoted DOGE across social media. Tesla began accepting DOGE for select merchandise in 2022. That move boosted mainstream awareness.

Cardano (ADA)

Cardano launched in 2017 as a layer one blockchain. The network supports smart contracts like Ethereum. Developers build decentralized apps on Cardano. The chain uses proof of stake to secure transactions. Charles Hoskinson founded Cardano. He also helped build Ethereum in earlier years. His reputation gave Cardano early credibility. ADA gained strong support soon after launch.The network focuses on research driven upgrades. The roadmap aims for long term stability. Development delays slowed growth at times. Some users find the ecosystem less intuitive than rivals. ADA powers the entire network. Users pay transaction fees with ADA. Holders stake ADA to earn rewards. Staking locks tokens and supports network security.

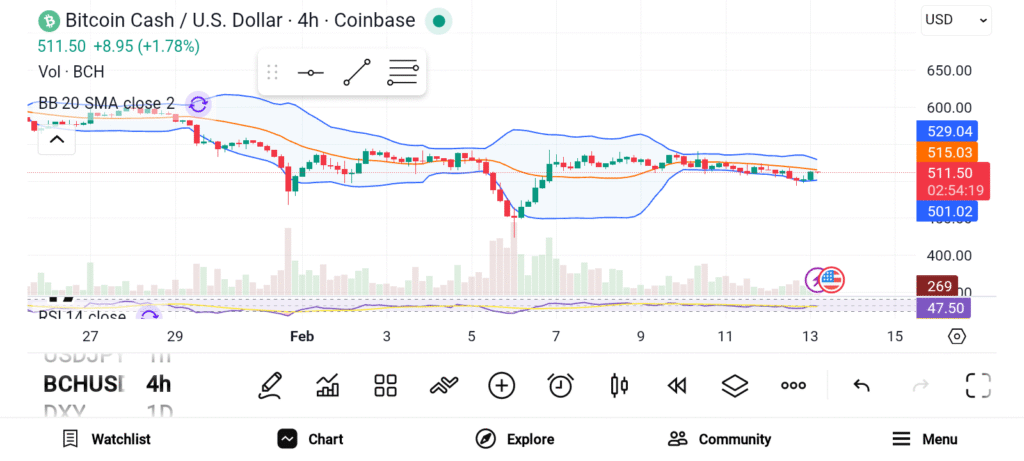

Bitcoin Cash (BCH)

Bitcoin Cash emerged from a split within Bitcoin. Community members disagreed on scaling strategy. The disagreement led to two separate chains. Bitcoin kept the original name. Bitcoin Cash moved forward as a competitor. BCH focuses on fast and affordable payments. Larger block sizes allow more transactions per block. That design lowers congestion during busy periods. Fees often stay lower than Bitcoin fees. Supporters promote BCH as digital cash for daily use. The network aims to handle everyday payments smoothly. Merchants can process transactions without long waits. BCH shares core principles with Bitcoin. Both rely on decentralized networks and mining. BCH simply prioritizes speed and capacity.

Dogecoin offers strong branding and loyal community support. Cardano delivers smart contracts and staking rewards. Bitcoin Cash focuses on fast and affordable payments. Each coin serves a different purpose, which creates diverse opportunities in 2026.