- PEPE continued consolidating around $0.054873 support and $0.05527 resistance and was not a directional momentum but instead a consolidation.

- PEPE has seen slight positive returns against BTC and ETH, even though the dollar movement is held down, which shows allocation changes in the crypto pairs.

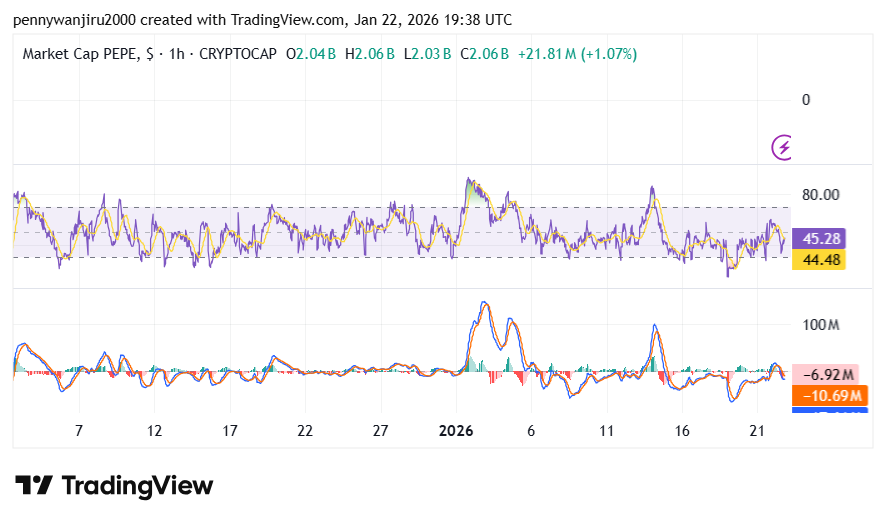

- The selective participation was supported by the vicinity of the neutral in the RSI and bearish structure of the MACD, which supported short-term equilibrium rather than aggressive positioning.

Pepe (PEPE) traded in the tight intraday range, and the price action was contained in the spot and crypto pair markets. PEPE was trading at $0.054947 at the time of reporting with a 0.1% price increase higher than it was in the previous 24 hours. The movement on the price behavior had been limited, and the movement was constrained between distinctly outlined support and resistance levels. This was a session where traders focused on short-term positioning, as opposed to directional acceleration. That context was the frame of the market structure that is seen in several periods of time.

PEPE Trades Sideways as Tight Range Persists Near Key Levels

The PEPE continued to hold on the price of $0.054873, avoiding the further decline of the price within the session. It is interesting to note that the price experienced a continuous value of above this level in the 24 hours. Nevertheless, the lack of advancement to the upside below $0.05527 was a limiting factor that constrained the price action. Consequently, the day range remained narrow, which shows limited volatility. This framework was based on previous modes of consolidation, which still prevailed in the short-term action. This resulted in a market that was more range maintenance oriented as opposed to breakout confirmation.

The movement of dollars was not high, but PEPE achieved small profits compared to large cryptocurrencies. The token had a gain of 0.3% corresponding to 0.0105533 BTC and traded at 0.081682 ETH equating to a 1.5 percent increase. These profits were achieved together with dampened dollar performances. Nevertheless, the deviation pointed out distribution realignment in crypto pairs. Consequently, the comparative power in regards to BTC and ETH provided some context to the session with no dollar range expansion.

Momentum Indicators Signal Neutral-to-Bearish Bias as Range Conditions Hold

Technical indicators on lower timeframes showed continued oscillation within established boundaries. The RSI was trading at 44.39 which shows the coin was neither overbought nor oversold.

Moreover, the MACD line was trading below the signal line showing the coin was in bearish momentum. Consequently, market participation appeared selective rather than aggressive. That environment reinforced short-term balance, linking dollar stability with gradual positioning across crypto pairs.