- MicroStrategy’s BTC portfolio is back in the green as the average purchase is $29,803.

- MSTR is also up by around 121% since the beginning of the year.

- BTC reached $30,000 today and the next zone to watch out for is from $31,600 to $32,500.

The Bitcoin (BTC) community rejoiced now that the chief crypto is now back at $30,000. This price was never seen since June 2022, 10 months from today.

Read CRYPTONEWSLAND onWhile many are still not back in the green, especially those who purchased BTC at its all-time high (ATH), MicroStrategy is finally back to profiting from heavily investing for many years. Specifically, MicroStrategy’s latest BTC buy revealed that the average cost of one bitcoin owned by the firm is $29,803.

Almost a week ago, Michael Saylor revealed that they bought an additional 1,045 bitcoins for $29.3 million. The latest stats announced by the firm stands at 140,000 bitcoins acquired for around $4.17 billion.

What is more, MicroStrategy’s stock has surged to around 121% since the beginning of the year. Now, many are confident that BTC’s rally will resume after weeks of barely moving between the $28,000 to $29,000 range.

As to the reason behind the price surge, BTC’s upward movement was due to heightened trading volume across various exchanges. There was no significant news that directly drove the market up.

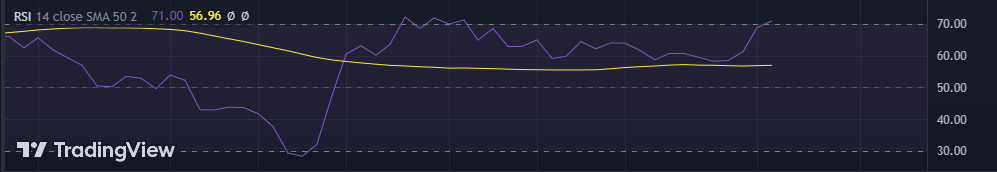

As seen in the chart above, BTC’s relative strength index (RSI) is close to being overbought. Now, BTC’s next target zone is from $31,600 to $32,500. This will only become possible if BTC gathers enough buyers at $30,000 to flip this psychological resistance level into support for the next leg.

Read Also :

disclaimer read moreCrypto News Land (cryptonewsland.com) , also abbreviated as “CNL”, is an independent media entity — we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.