- Lazarus Group steals $1.4B from Bybit, moving funds through Solana’s Pump.fun platform.

- Solana’s price drops 4% amid concerns over hack-related laundering and FTX asset release.

- Solana’s active addresses fall 39%, with bearish market sentiment and hack fallout.

The cryptocurrency industry experienced its largest exploit after Bybit announced a $1.4 billion hack on February 21, 2025. The cybersecurity company Arkham Intelligence, together with other blockchain security firms, confirmed North Korea’s Lazarus Group as responsible for the attack. The stolen digital assets encompass staked Ethereum tokens stETH along with Mantle Staked ETH tokens mETH and multiple other cryptocurrencies resulting in concerns about their blockchain network movement.

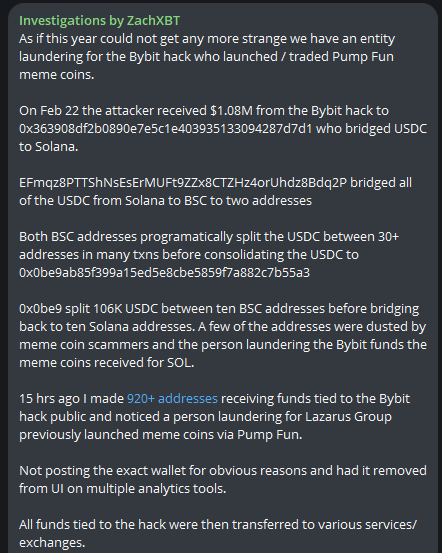

Recent investigations by onchain analyst ZachXBT revealed that the Lazarus Group may also be laundering the stolen funds through Solana’s Pump.fun platform. On February 22, the attacker received $1.08 million from the Bybit hack and bridged the funds, primarily USDC, to SOL. These funds moved through multiple wallets, some linked to prior memecoin scams before being distributed across various exchanges.

Solana Faces Pressure from Hack-Related Activities

The cryptocurrencies price dropped 4% on February 22, 2025, trading as low as $167, amid bearish market sentiment tied to the Bybit hack. Reports indicate the hackers used Pump.fun to launch memecoins, potentially laundering the stolen assets. For instance, a wallet linked to the exploit transferred 60 SOL to launch a token called QinShihuang, which saw over $26 million in trading volume.

This activity has fueled negative perceptions of SOL, especially following recent memecoin scandals like the Libra token rug pull. The blockchain’s association with high-profile exploits, including the Bybit and Phemex hacks, has contributed to a decline in user activity. Active addresses on the cryptocurrencies fell to a weekly average of 9.5 million in February 2025, down from 15.6 million in November 2024.

Upcoming FTX Asset Unlock Adds to Solana’s Challenges

Solana faces additional pressure from the impending distribution of FTX estate assets. Starting March 1, 2025, FTX plans to release 11.2 million SOL, valued at approximately $2.03 billion. While over-the-counter sales might ease immediate selling pressure, the market remains cautious, as evidenced by Solana’s recent price decline.

Analysts suggest the combination of hack-related laundering and the FTX unlock could intensify selling pressure on the cryptocurrencies. The cryptocurrencie’s price might drop below $150 if bearish trends persist, testing key support levels. However, recovery depends on increased buying volume and Solana regaining key resistance levels above $170.