The crypto market is once again under pressure, and investor confidence is being eroded at a high rate. In the past six months, Ethereum has lost more than 60 percent. The question is where the market is going. Conversations on Ethereum price prediction are becoming defensive as the selling pressure increases and recovery efforts are unable to sustain.

As Ethereum is still trying to restore confidence, Remittix, the best crypto to buy now, is heading the opposite way, following the sale of over 710 million tokens at $0.123 apiece, raising over 29.3 million USD. This is forcing investors to reconsider where the real opportunity is in a wary market.

Ethereum Price Prediction Weakens As Large Holders Continue Selling

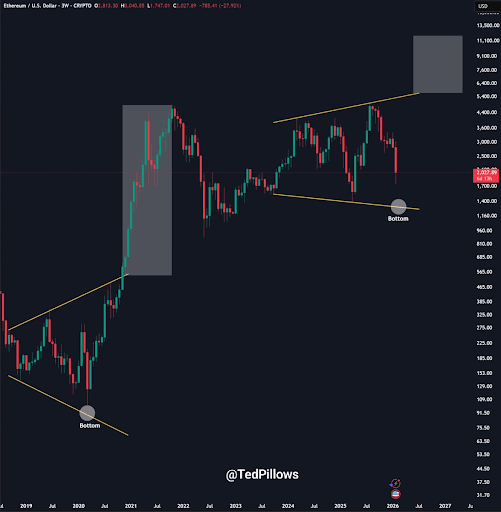

Source: Ted Pillows

Selling pressure has been piling up, making Ethereum price prediction less and less solid. Vitalik Buterin, the co-founder of Ethereum, sold over 6,100 ETH across days last week. Other large holders also reduced exposure, often to repay loans, adding supply during a period of falling prices. This activity has added weight to bearish Ethereum price prediction outlooks.

As of February 9, Ethereum is trading near the $2,100 level, down 9% on the week and far below recent highs. ETH remains under short-term moving averages, with the EMA20 near $2,446 acting as resistance. The Supertrend indicator also remains bearish, with resistance around $2,606. These signals continue to reinforce a cautious Ethereum price prediction in the near term.

On-chain data deepens concern. CryptoOnchain reports that Ethereum’s 14-day average of tokens transferred surged to its highest level since August 2025. This spike occurred as prices were declining from above $3,000 down to the low 2000s. This trend in history can also tend to be indicative of panic-selling behavior, with assets being sold to exchanges or swapped to stablecoins. The divergence is frequently viewed as a sign of warning in Ethereum price prediction models and not a bullish indicator.

Wider market conditions are not assisting. Bitcoin is still dominating the market, liquidity is tight, and there is no significant catalyst that has taken place with Ethereum. The Ethereum price prediction is not associated with the possibility of improvements but with the downside risk and consolidation until the volume is regained with conviction.

Why Remittix Is Gaining Strength As Ethereum Struggles

While Ethereum price prediction reflects uncertainty, Remittix is attracting attention for the momentum that is already unfolding. One major driver is the active 300% email-only bonus, which allows participants to receive significantly more tokens during this final stage. This bonus has helped accelerate participation as the project approaches an early sell-out phase, concentrating demand rather than spreading it thin.

Beyond incentives, Remittix is being built around real-world use. The PayFi platform launch is scheduled for today, February 9, with all systems ready to go live. The final step is KYC provider activation, after which the app and platform will be fully switched on. This marks a clear transition from development to execution, something investors value in uncertain markets.

Security and infrastructure also play a key role. The project has completed CertiK verification, confirming strong security standards and transparency. Its mobile wallet is already live on the Apple App Store, with Android access expected next. Unlike assets weighed down by selling pressure, Remittix is moving forward based on milestones rather than sentiment.

Key reasons investors are focusing on Remittix include:

- A crypto-to-fiat payment system built for everyday use

- Support for over 40 cryptocurrencies and more than 30 fiat currencies

- CertiK verification reinforces platform security and trust

- A live mobile wallet with full PayFi activation underway

- A business API designed to drive real-world payment adoption

As the Ethereum price prediction remains under pressure, investors are gravitating toward projects that are executing now instead of waiting for conditions to improve.

Why Investor Attention Is Shifting

Ethereum price prediction concerns are no longer just about charts. They reflect deeper issues tied to supply pressure, weak conviction, and the absence of a clear catalyst. Large-holder selling and rising network activity during falling prices have shaken confidence across the market.

In contrast, Remittix is benefiting from a shift in investor mindset. Instead of chasing rebounds, capital is moving toward projects with visible progress, strong participation, and near-term execution. With a live platform rollout, verified security, and a powerful 300% email-only bonus driving demand, Remittix is increasingly viewed as the stronger opportunity in a market searching for clarity.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix