Ethereum news today is putting a spotlight on one of the biggest high-conviction bets in the crypto market and the risks that come with it. While Ethereum remains a core pillar of blockchain technology and decentralized finance, recent price weakness has pushed even the most confident holders into uncomfortable territory. At the same time, many crypto investors are shifting capital toward earlier-stage opportunities like Remittix, which is rapidly gaining attention as a top crypto under $1 with real utility and a rare 300% private bonus.

This contrast defines the current crypto market. On the one hand, the news about Ethereum is overwhelmed by the pressure on big institutional owners. Alternatively, altcoins with a more defined upside, good tokenomics, and launch dates are increasingly in demand. Remittix sits right at the center of that shift.

Ethereum News: Why Bitmine’s ETH Position Is Under Serious Pressure

The most recent Ethereum news has been centered on BitMine Immersion Technologies, the biggest Ethereum-centric treasury firm, headed by the renowned Wall Street strategist Tom Lee. Although ETH has been increasing by over 4% over the last 24 hours, Ethereum continues to trade at close to $2,111. That level is far below where many expected ETH to stabilize this cycle.

BitMine has accumulated roughly 4.285 million ETH at an estimated cost of $15.65 billion. At current prices, that position is now worth around $9 billion. This places the company between $6 billion and $8 billion in unrealized losses. Even more striking, BitMine recently bought another $40 million worth of Ethereum despite already sitting deep underwater.

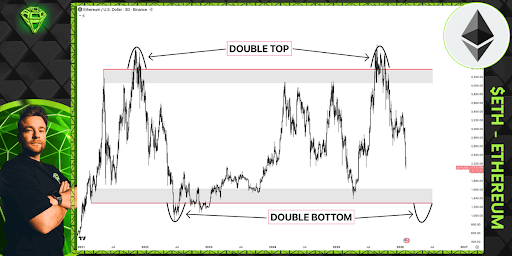

Source: @AltCryptoGems on X

According to Ethereum news analysts, the only thing that is going to keep BitMine afloat is time and Ethereum price recovery. Provided that ETH recovers to the $3,000 to $4,000 spectrum in the next few months, then the story turns the other way, and the wait seems worthwhile. Should Ethereum keep falling to the $1,500s or beyond, trust can be broken.

Momentum indicators are not assisting. Both RSI and MACD are incredibly weak, and Ethereum is in oversold territory that it has not been in since 2024. The major levels to monitor are: $1,900 and $1,800. A larger risk-off environment places support of about $1,580, $1,350, and even $1,080. If these levels are tested, BitMine may be forced to sell Ethereum to manage balance sheet pressure.

Why Remittix Is Gaining Momentum As Ethereum News Turns Cautious

Remittix is positioning itself as a bridge between decentralized finance and real-world payments. While Ethereum news focuses on price defense, Remittix is focused on delivery. The project has now raised over $29.1 million by selling 707 million tokens at $0.123 each. More than 93% of the total supply is already sold, leaving very limited room for late buyers.

Unlike many DeFi projects that exist only on roadmaps, Remittix already has a working product. The Remittix Wallet is available at the Apple App Store, and the Android version is also on the way, which will increase accessibility and reach. Another factor pushing Remittix is a private 300% bonus available exclusively via email. That exclusivity adds urgency and scarcity, two forces that strongly influence capital flows in the crypto market.

The full crypto-to-fiat PayFi platform launches on February 9, 2026. This platform aims to solve one of crypto’s biggest problems: turning digital assets into usable money without friction. That real-world focus is why many now see Remittix as the best crypto to buy now in 2026.

Security and transparency are also major factors. Remittix has completed KYC verification with CertiK and holds a Skynet Score of 80.09, ranking it number one among all pre-launch projects. Over 24,000 community ratings support this trust, a rare level of validation in early-stage crypto.

Key factors driving Remittix adoption include:

- Over 93% of the total token supply is already sold, with 707 million RTX tokens locked in by early buyers.

- A live wallet product is already available on the Apple App Store, giving users a working, secure way to store and manage digital assets.

- The full crypto-to-fiat PayFi platform launches on February 9, 2026.

- Remittix has completed KYC verification with CertiK and holds a Skynet Score of 80.09.

- A private 300% email-only bonus is accelerating demand, giving select early participants a larger allocation before public access and listings begin.

Why Ethereum News And Remittix Are Telling Two Different Stories

Ethereum’s long-term future remains strong, but Ethereum news today reflects short-term stress for large holders. BitMine’s situation shows how even conviction backed by billions can become fragile when prices fall. Remittix represents the opposite side of the cycle. It is early, it is building, and it is approaching key milestones. With confirmed centralized exchange listings on the way, two secured listings, and a PayFi launch scheduled, Remittix is the best new crypto to buy now.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix