- Bitcoin (BTC) hit more than 125,000 confirming its dominance in the Crypto market, great liquidity, institutional pressure, and continued positive trends into 2025.

- Etherium (ETH) has risen back to a price of $1,475 to 4,846 and it is now starting to show signs of renewed stability and technical power, which is likely to break out at the start of 2025.

- XRP leapfrogged to levels of $3.55 upheld by a strong level of $3.00 and an indication that it can consolidate significantly to cause further growth in 2025.

Cryptocurrency market still reflects a good performance as big digital assets rebound and tighten their belts in anticipation of a potential breakout in the 2025. Bitcoin (BTC), Ethereum (ETH), and XRP have all demonstrated the newfound strength of their prices, as the flow of purchases and the overall mood of the global market have improved. Such coins have now been placed to be the best short term opportunities in case of those interested in holding them in 100 days in 2025.

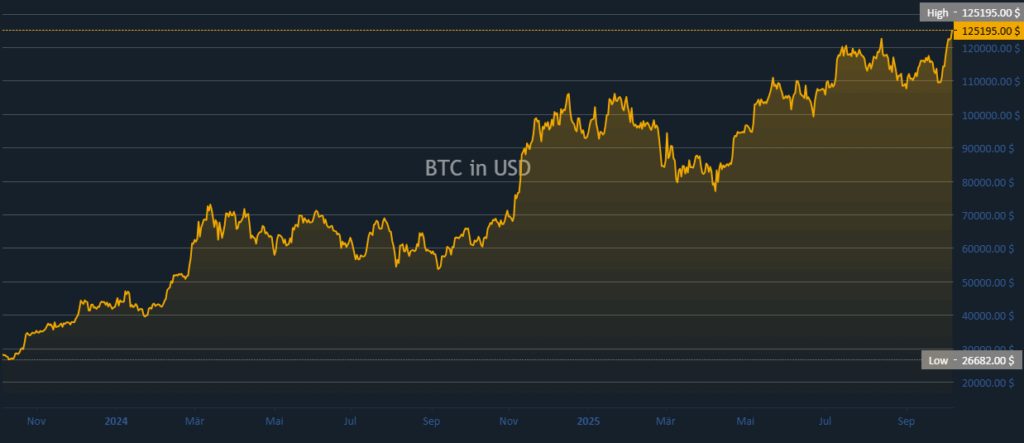

Bitcoin (BTC) Exhibits a Strong Stabilization and dominance.

Bitcoin is the best cryptocurrency as it is still continuing to show active price movement till 2024 and even 2025. The digital asset improved its long-term progress by moving between a low of $26,682 to a new high of 125,195. This increase solidified the position of Bitcoin as it has gone across several areas of resistance and has been able to keep its good liquidity all year round.

Source: blockchaincenter

The upward trend in prices was consistent with a strong institutional demand and macroeconomic conditions. Bitcoin had a brief correction at around $90,000 but soon moved back upward, as it was accumulated throughout the pullbacks. Besides, the reaction of the market to these rebounds showed that long-term holders were still operational when the market was experiencing short-term retracements.

Today, the price of Bitcoin is moving close to its apex, which is an indication of the market continuing to be strong into 2025. The technical momentum and strong support base of the past consolidation areas can be traced in the sustained growth. As the volatility has been controlled and the liquidity enhanced, the Bitcoin can still be the best performer to those who intend to have a short-term exposure in the next 100 days.

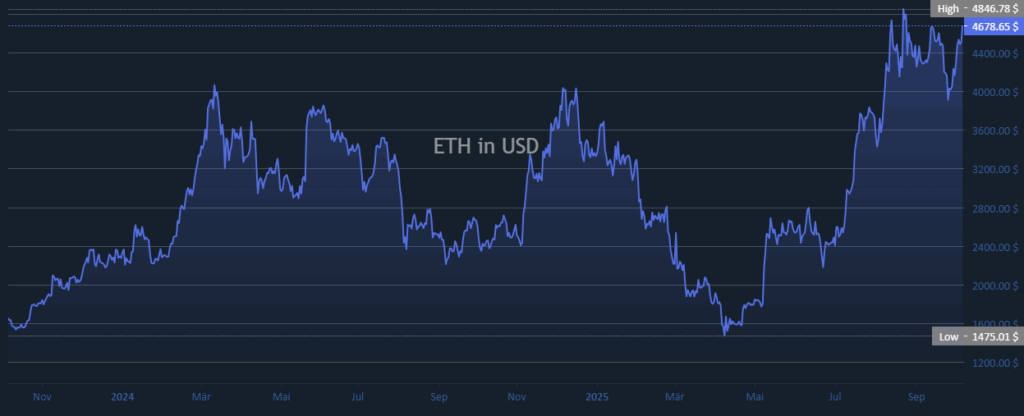

Etherium (ETH) Has New Strength following a High Volatility.

Ethereum shows a unstable but encouraging recovery, indicating stability following previous fluctuations in 2024. The asset increased by 1,475 to 4,846 and it was a big recovery since the market had gone through long periods of correction. This trend served as an indication of increased trust in Ethereum ecosystem since they have continued to hold above the price of 4000 in recent weeks.

Source: blockchaincenter

The trading between the range of 2,000 and 4,800 depicted the alternation of accumulation and taking profits, which meant that the market remained active. Even with its extreme volatility, Ethereum did not lose its long-term construction and did not experience more severe drops, as the demand seems to be strong. Moreover, stable prices at the major resistance areas reinforced the prospects of short-term growth.

The recent price action of Ethereum indicates that there is the likelihood of another breakout in case the positive sentiment persists in the early part of 2025. Its contribution to decentralization of finance and smart contract infrastructure still remains a foundation of value increase. All in all, Ethereum is a medium-term opportunity, and it can be seen as a blend of technical prowess and the overall interest in the market.

XRP Shows Momentum of Explosive Potential and Firm Consolidation.

XRP showed one of the greatest price changes in the current cycle, as it increased by 3.55 since the last price (0.42). It broke out in late 2024, and it gained momentum in early 2025, which represented a point of decisive change in market sentiment. The boom was provided by the increase in the trading volume and the new optimism in the prospects of long-term adoption.

Source: blockchaincenter

Having reached the peak, XRP passed to the stage of consolidation and was supported exceeding the level of 2.50. This range indicated a balance between buy action and profit taking action, indicating that the market is strong even though it would be fluctuating in the short term. In addition, its capacity to hold as far as 3.00 is a sign that it has a good technical ground to start another rally.

With further gains due to momentum to 2025, the technical structure of the XRP remains in support of additional gains. It ranks as a leading company because of enhanced liquidity as well as structural recovery over the long term. Short-term XRP is a good investment with high volume and stability in its performance, which makes it a great candidate in a 100-day holding period.