- Sui Network offers fast transactions, developer-friendly tools, and growing adoption in NFT and gaming projects.

- Solana provides high-speed, low-cost transactions with thriving consumer apps and Solana Pay integration.

- Ripple focuses on institutional payments, fast cross-border transfers, and expanding global banking partnerships.

The crypto market in 2026 rewards networks that deliver real utility. Users care less about promises and more about performance. Developers choose platforms that reduce friction and cost. Investors follow usage, not noise. Several blockchains now stand out for consistent growth. Sui, Solana, and Ripple each show rising adoption across different sectors. These projects support gaming, payments, and financial infrastructure. Together, they reflect where demand flows this year.

Sui Network (SUI)

Sui Network launched with a strong focus on speed and scalability. Former Meta engineers designed the network for modern applications. Parallel execution allows multiple transactions to process at the same time. This structure reduces congestion during peak activity. Developers consistently praise the clean tooling and smooth workflow. Many teams report faster deployment and easier testing. The network attracts builders from NFT and gaming sectors. These applications demand high throughput and stable performance. Sui meets those needs without complex workarounds. Gaming studios now explore early integrations and pilots. That attention signals growing confidence from professionals. If crypto gaming matures this year, Sui could support large user bases. The builder-first design creates a solid foundation for long-term growth.

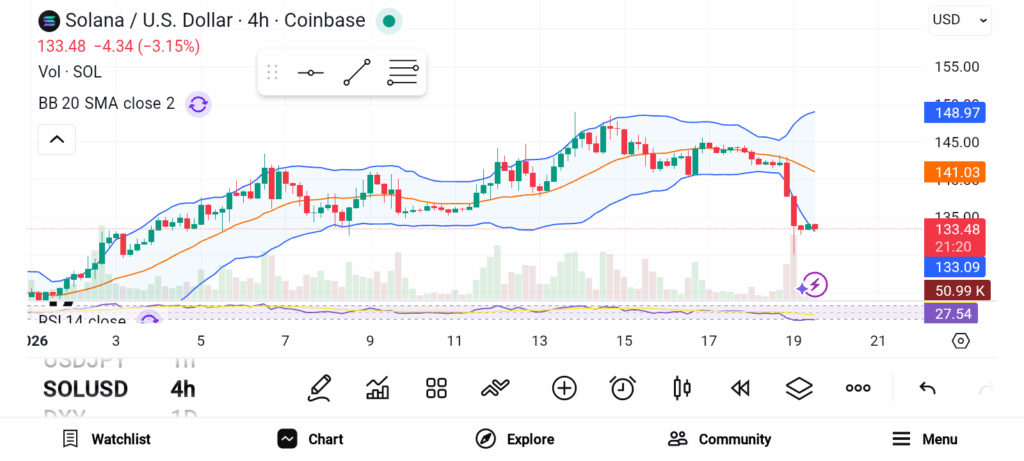

Solana (SOL)

Solana continues a strong recovery phase. Earlier setbacks forced improvements across the ecosystem. Speed and low transaction costs remain key advantages. Consumer-facing applications now thrive on the network. NFT platforms and DePIN projects draw daily activity. These apps rely on fast confirmation and minimal fees.Investment firms recognized Solana as a top growth network in 2025. Firedancer arrived as a major technical upgrade. This new validator client improved stability and throughput. Network reliability now meets higher expectations. Solana Pay also gains merchant interest. Shopify integration opened real retail use cases. These developments push Solana beyond speculation. The network now supports both builders and mainstream users.

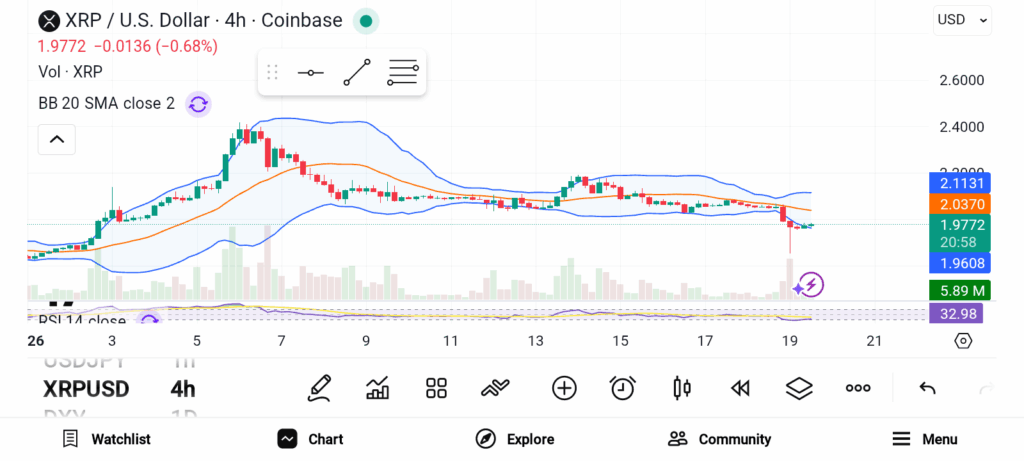

Ripple (XRP)

Ripple Labs enters 2026 with renewed confidence. Years of regulatory uncertainty slowed progress. Recent clarity unlocked growth. XRP posted strong gains by mid-year. Institutional interest drives that momentum. RippleNet continues expanding partnerships with global banks. The XRP Ledger focuses on fast and low-cost payments. Financial institutions value speed and predictability. Cross-border transfers remain the core use case. ETF discussions add further legitimacy. XRP does not rely on trends or hype cycles. The project grows through steady enterprise adoption. This approach attracts investors seeking stability.

Sui focuses on developer ease and gaming performance. Solana powers consumer apps with speed and reliability. Ripple strengthens institutional payment networks worldwide. Each project shows measurable adoption growth. Together, these cryptos highlight practical blockchain demand in 2026.