Key Insights:

- Chainlink’s price has dropped below crucial Fibonacci levels, with $7.24 now acting as strong support.

- Derivatives and exchange flow data show reduced leverage and less aggressive selling, signaling easing bearish pressure.

- Ondo’s integration with Chainlink boosts its DeFi use case, combining traditional assets with decentralized pricing.

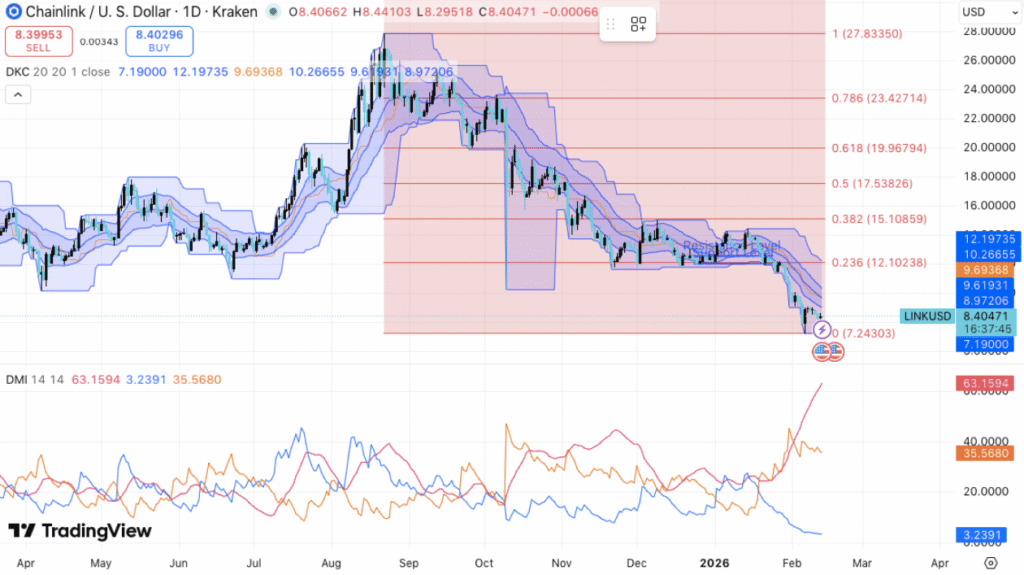

Chainlink (LINK) continues to battle a sustained bearish trend as the price faces significant downside pressure. After reaching highs in the $26–$28 range, the asset has struggled to regain momentum, printing lower highs and lower lows across the daily chart. This persistent downward price action confirms that sellers remain in control, resulting in a fresh breakdown below the key consolidation zone. The price recently dropped toward $8.40, now sitting just above a crucial support floor.

Chainlink failed to defend the $12.10–$12.20 region, which aligns with the Fibonacci 0.236 retracement level. Once this area flipped to resistance, fresh selling pressure triggered further losses, pushing the price toward the cycle low of $7.24. This level now serves as major structural support. A failure to hold $7.24 could lead to a drop toward the $6.50–$7.00 psychological demand zone, with the next downside target potentially reaching the $5.00 area if selling pressure intensifies.

Indicators Show Cooling Selling Intensity

Although the price continues to trend lower, derivatives and exchange flow data suggest a shift in market dynamics. Open interest data, which tracks leveraged positions, has decreased significantly from its previous highs above $1.5 billion. This cooling of leverage indicates more cautious participation from traders. Similarly, recent spot flow data reveals mixed inflows and smaller negative netflows, indicating that bearish sentiment may be fading.

Despite the bearish tone, a relief bounce could occur if the $7.24 support holds. Immediate resistance lies between $9.60 and $10.20. A sustained rally above this range could signal a potential recovery toward the $12.10 Fibonacci level. If buyers manage to reclaim this key zone, it may pave the way for a larger reversal toward $15.10 and possibly $17.50, marking a significant trend shift.

Expanding Utility for Chainlink in DeFi

Beyond the price action, Chainlink’s ecosystem continues to grow, with key integrations enhancing its role in decentralized finance (DeFi). Recently, Ondo Global Markets launched real-time price feeds for tokenized U.S. equities using Chainlink oracles on Ethereum. These price feeds support assets like SPYon, QQQon, and TSLAon, which could significantly boost Chainlink’s utility in DeFi markets. This expansion into traditional financial markets could drive long-term demand for LINK, even as price action remains under pressure.

Chainlink is at a critical juncture. Whether the price holds the $7.24 support or breaks lower will be crucial in determining its next move. Market sentiment, along with derivatives participation, will play a key role in shaping the future price action.