- Bitcoin Fear and Greed Index currently at 86, indicating extreme greed among investors

- Recent bullish price action and institutional interest contribute to growing optimism among investors

- High levels of greed may be a warning sign for potential corrections, reminding investors to remain cautious and make informed decisions.

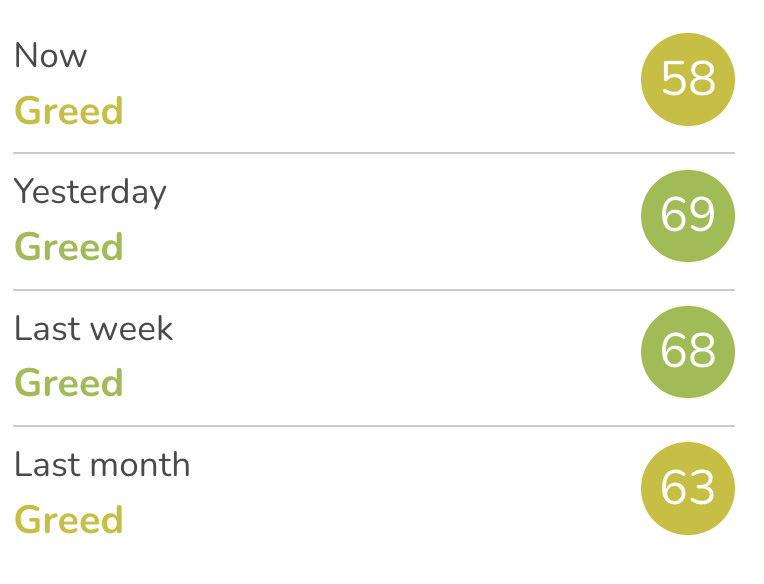

The Bitcoin Fear and Greed Index has reached a level that has not been seen since November 2021, when Bitcoin (BTC) was trading above $50,000. The index, which is a metric that measures investor sentiment towards Bitcoin, currently stands at a score of 86, indicating extreme greed among investors.

The index measures a variety of factors, including price momentum, market volatility, and trading volume, to determine whether investors are feeling fearful or greedy about the market. The higher the score, the more greedy investors are feeling, while a lower score indicates a more fearful sentiment.

The current spike in the index can be attributed to several factors, including the recent bullish price action of Bitcoin, with the cryptocurrency reaching a new all-time high of over $68,000 in November. Additionally, the increasing adoption and institutional interest in Bitcoin has contributed to a growing sense of optimism among investors.

However, some analysts have warned that such high levels of greed can be a sign of a market top and may lead to a correction in the near future. It is worth noting that Bitcoin has historically experienced significant price corrections following periods of extreme greed in the market.

Despite these warnings, many investors remain bullish on Bitcoin and see it as a long-term investment opportunity. The current level of the Fear and Greed Index serves as a reminder to investors to remain cautious and not let greed cloud their judgment when making investment decisions.

Overall, the Fear and Greed Index serves as a useful tool for investors to gauge market sentiment and make informed investment decisions. While high levels of greed can be a warning sign for potential corrections, it is important for investors to remain level-headed and make decisions based on careful analysis and risk management.