- Binance founder Changpeng Zhao begins a four-month prison sentence for facilitating money laundering on the platform.

- Zhao’s reduced sentence of four months contrasts with the initial prosecution’s aim for three years, reflecting legal negotiations.

- Zhao’s case draws comparisons to Sam Bankman-Fried, highlighting differing sentences in high-profile cryptocurrency fraud cases.

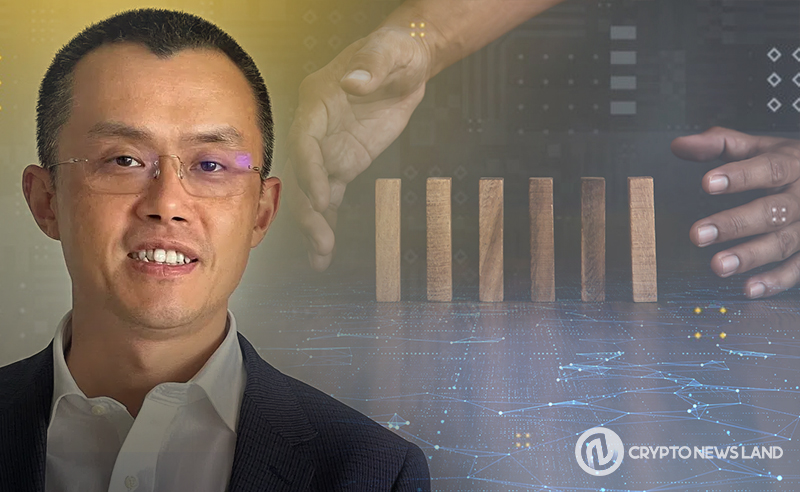

Changpeng Zhao, the billionaire founder of Binance, the world’s largest cryptocurrency exchange, has surrendered to a low-security federal prison in Lompoc, California. This development comes after Zhao pleaded guilty to charges of facilitating money laundering on the platform, leading to his sentencing in April.

Zhao, commonly known as CZ in the cryptocurrency community, began his four-month prison sentence following a legal battle that saw federal prosecutors initially seek a much harsher penalty. Originally, prosecutors aimed for a three-year sentence, while the defense team from Latham & Watkins had advocated for five months probation. The sentencing guidelines had recommended a term ranging from 12 to 18 months. In the end, U.S. District Judge Richard Jones handed down a significantly reduced sentence of four months.

Before his sentencing, Zhao appeared before the court to express his remorse and take full responsibility for the oversight. “I’m sorry,” Zhao stated, according to Reuters. He further admitted, “I believe the first step in taking responsibility is to fully acknowledge the mistakes. I failed to implement an adequate anti-money laundering program here… I now realize the seriousness of this mistake.” This admission marked a pivotal moment in the hearing, reflecting Zhao’s acknowledgment of the gravity of his actions and their repercussions.

Zhao’s prison term has drawn comparisons to another high-profile case in the cryptocurrency world involving Sam Bankman-Fried, the founder and former CEO of FTX. Bankman-Fried is currently serving a much lengthier sentence of 25 years in a federal prison. Convicted on seven criminal counts related to securities fraud conspiracy, Bankman-Fried’s fall from grace was marked by the collapse of his cryptocurrency exchange and the related hedge fund, Alameda Research. In addition to his prison sentence, Bankman-Fried was ordered to pay $11 billion in forfeiture, a significant financial blow reflecting the scale of the fraud.