- ATOM dropped 32% after a Binance glitch caused panic among traders.

- ENJ fell 67% before rebounding nearly 100%, facing key resistance near $0.054.

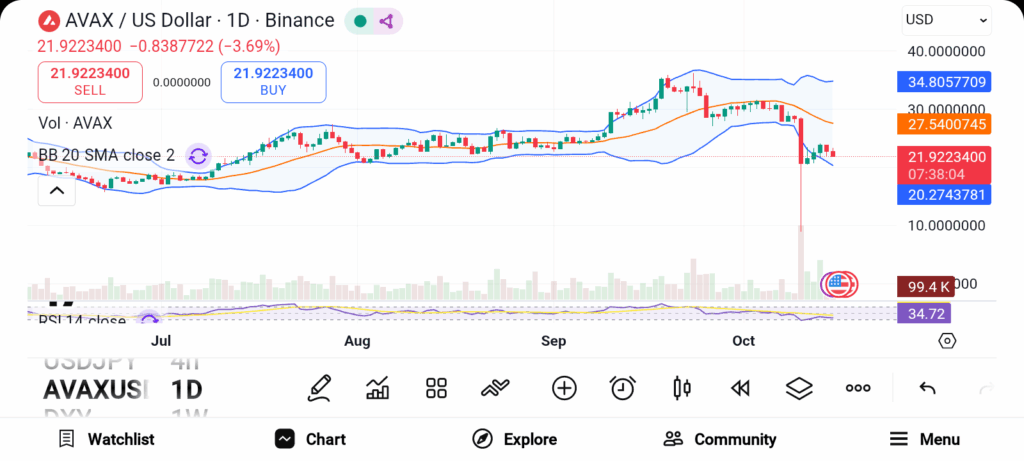

- AVAX crashed 70% but recovered to $22, supported by strong whale accumulation.

The crypto market turned red on Black Friday as traders watched prices plunge across several tokens. Some coins dropped sharply due to technical glitches, while others faced genuine sell-offs triggered by fear and liquidity shocks. The chaos left many investors stunned and uncertain about what went wrong. Let’s look at three major altcoins—Cosmos, Enjin, and Avalanche—that took heavy hits during this market meltdown and how they’re recovering.

Cosmos (ATOM)

ATOM saw one of the most alarming drops during the Black Friday crash. On Binance, ATOM’s price briefly showed $0.001, a 99.9% drop that sent shockwaves through the market. Analysts later confirmed that the fall was a “false print” caused by a tick-size glitch. Despite the glitch, real trading data from Coinbase showed a significant 32% decline from $4.19 to $2.99 in just one day. Technically, ATOM remains under bearish pressure on the daily chart. The token continues to trade below the main downtrend line, facing resistance near key Fibonacci levels. The $3.35 mark now acts as a crucial support area.

Enjin (ENJ)

ENJ was one of the tokens that went through an extremely volatile moment during the crash. The token on Binance showed a value of $0.00001 for a very short period, which means that the chart was wiped out. Yet, that wasn’t the accurate depiction. On OKX, ENJ dropped from $0.063 to $0.021, which is a 67% decrease—still a heavy drop, but not a complete crash.

Enjin after the fall, really went out of its way to showcase its power to the doubters, which is why it shot up from $0.021 to nearly $0.048 within a couple of days. Although the near-100% recovery demonstrated rapid recovery energy, there are still some issues. The first significant obstacle is at $0.054, and then there is a tough resistance area between $0.060 and $0.074.

Avalanche (AVAX)

Avalanche’s AVAX faced a genuine 70% crash on Black Friday, without any technical errors or false prints. The token plunged to $8.53 before rebounding sharply in the following sessions. Unlike other coins, AVAX’s fall reflected real selling pressure rather than exchange issues. Since the crash, AVAX has staged a steady recovery, now trading near $22. Large investors, often referred to as whales, have been accumulating AVAX during this rebound. The Chaikin Money Flow (CMF) indicator shows strong buying pressure, crossing above the zero mark.

Cosmos suffered a panic glitch, Enjin endured a deep but temporary crash, and Avalanche faced a real sell-off. Despite the chaos, all three have shown signs of stabilization. Market glitches and volatility remind traders how fragile sentiment can be. As recovery continues, holding key support levels will determine which tokens emerge stronger from this Black Friday bloodbath.