- Sei Network: Major upgrades and new integrations drive strong growth and rising institutional confidence.

- Monad: High capacity and strong on-chain activity support a powerful long term outlook.

- Ethena: Yield-focused stablecoin design attracts users seeking steady returns with lower risk.

Fresh AI-driven analysis points toward three standout altcoins with serious momentum behind them. Strong development progress, rising adoption, and growing institutional interest shape the outlook for each project. Many traders now track these networks due to rapid expansion and heavy usage across real applications. The three tokens below show strong fundamentals that support long term confidence. Each project delivers unique strengths that attract active communities and serious builders. These factors create powerful upside potential.

Sei Network (SEI)

Sei Network recently gained major attention after inclusion in Coinbase COIN50 and Vanguard DIME. That recognition signals strong confidence from large institutions. A massive performance upgrade increased throughput by nearly fifty times. The network now aims for more than one hundred thousand transactions per second. Recent integrations with Kalshi and MEXC help expand real usage across many categories.

A growing community now supports rapid ecosystem progress. Many developers choose this environment due to smooth performance and strong support. Active adoption fuels momentum across trading platforms and consumer applications. A rising level of trust from institutions adds another layer of strength. These signals place Sei Network among the strongest growth candidates.

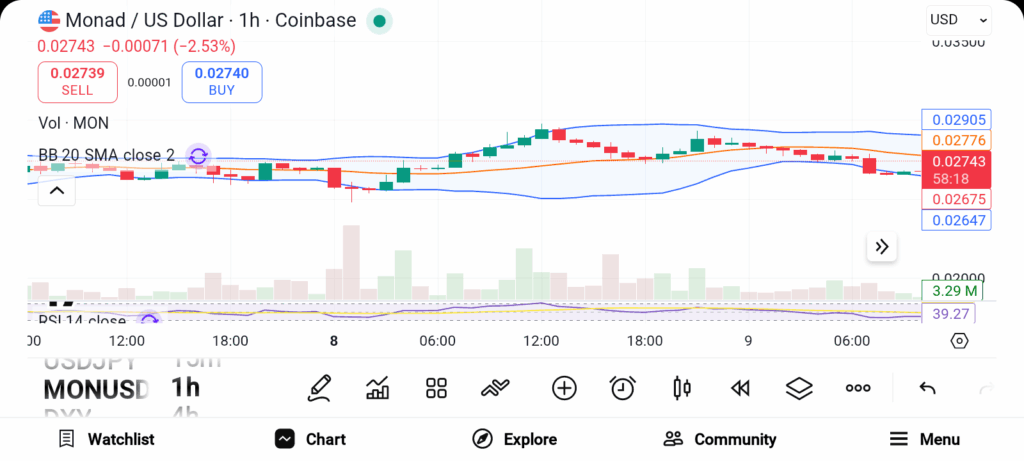

Monad (MON)

Monad processes around two and a half million daily transactions while using only a tiny fraction of total capacity. That leaves a huge opportunity for future expansion. On-chain data shows the MON and USDC pools generating strong activity. High volume and strong yield attract many traders.

A recent funding round led by Kizzy brought even more confidence. The round finished with heavy demand from early supporters. Developers behind Monad continue to improve performance across all core areas. Many analysts highlight strong fundamentals and large room for growth. This combination strengthens the long term outlook for this project.

Ethena (ENA)

Ethena focuses on stablecoin performance supported by delta neutral strategies. The USDe stablecoin generates yield automatically for holders. That yield reached four percent during the last month. Many users appreciate a stable option that provides reliable passive return. Traditional savings accounts offer far lower returns.

Treasury bills also fall below the level seen on USDe. As interest rates decline, many users search for alternatives that provide stronger performance. Ethena offers a model that blends crypto flexibility with low risk yield generation. This design attracts serious attention from traders, builders, and institutions.

Sei Network shows strong growth backed by major institutional recognition. Monad delivers huge capacity and strong on-chain activity across many users. Ethena provides stable yield through delta neutral strategies and strong design. All three altcoins show strong adoption, rising momentum, and powerful growth potential.