- Celer Network: Cross-chain scaling protocol enabling fast, low-cost transfers and multi-chain application development.

- LUKSO: Identity-focused Layer-1 blockchain built for creators, digital assets, and consumer-friendly applications.

- Nolus: Capital-efficient DeFi lending protocol offering leveraged access with partial liquidations and predictable interest rates.

The next bull run will likely reward projects that quietly build real infrastructure. Hype fades fast, but utility tends to last. Scalability, identity, and capital efficiency stand out as major growth areas. Some smaller projects already focus on these problems. Celer Network, LUKSO, and Nolus fit that profile well. Each addresses a clear limitation in crypto today. That focus gives these tokens strong upside potential for 2026.

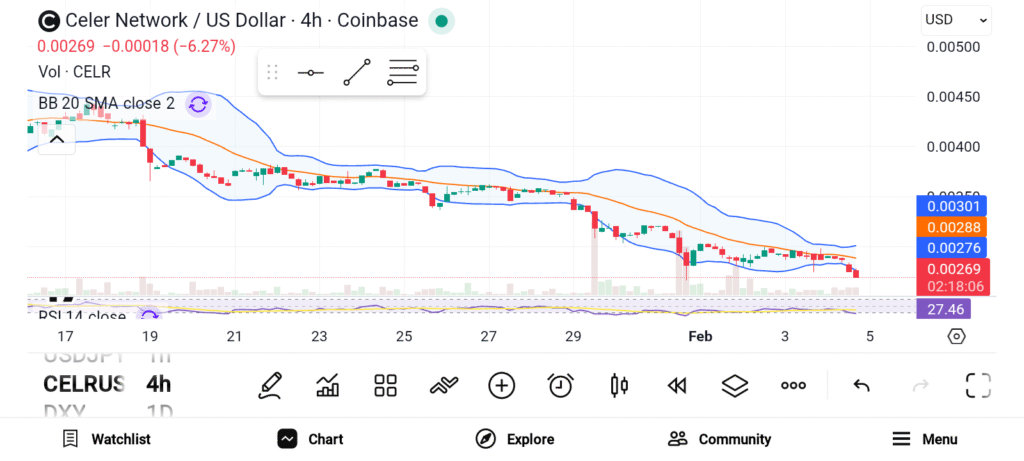

Celer Network (CELR)

Celer Network focuses on speed, cost reduction, and cross-chain connectivity. The protocol operates as a Layer-2 scaling and interoperability solution. Developers use Celer to move assets and data across multiple blockchains. Supported networks include Ethereum, BNB Chain, Polygon, and Arbitrum. cBridge serves as the flagship product. The bridge has recorded strong growth in liquidity and daily usage. Users rely on cBridge for fast and low-cost cross-chain transfers. Celer also offers an inter-chain messaging framework. This framework supports decentralized applications across more than forty blockchains. The CELR token supports staking, governance, and transaction fees. Ongoing updates and new integrations show active development. Cross-chain infrastructure remains a major adoption hurdle. Celer positions itself as a core solution to that challenge.

LUKSO (LYX)

LUKSO targets digital identity and creator-driven economies. The network operates as a Layer-1 blockchain built on Ethereum Virtual Machine. Universal Profiles form the core innovation. These profiles act as smart accounts with built-in permissions and metadata. Developers can design user-friendly applications without complex wallet interactions. LUKSO focuses on fashion, digital collectibles, and creator tools. These sectors demand better identity and asset management. Traditional blockchains often struggle with usability in these areas. The LYX token powers transactions and staking on the network. The mainnet remains live and under active development. Modular contracts and account abstraction improve flexibility. LUKSO aligns well with consumer-focused blockchain adoption trends.

Nolus (NLS)

Nolus aims to fix capital inefficiency in decentralized lending. The protocol introduces a lease-based borrowing model. Users can access financing up to one hundred fifty percent. This approach reduces heavy overcollateralization. Partial liquidations replace full liquidation events. This structure lowers risk during volatile price swings. Borrowers also benefit from locked interest rates. Predictable costs help users plan long-term positions.Nolus runs on the Cosmos SDK. The NLS token supports governance, staking, fees, and incentives. Lending efficiency remains a major DeFi challenge. Nolus offers a practical solution with clear user benefits.

Celer Network, LUKSO, and Nolus tackle real problems in crypto infrastructure. Each project targets a different growth sector. Active development supports long-term relevance. Smaller market caps increase upside potential. These gems may shine during the 2026 bull run.