- Cardano remains above $0.82, which indicates the existence of a strong crypto structure and a chance of a slow recovery.

- SUI Nears Technical Reversal Zone: SUI has entered into a short-term downtrend but its bearish momentum could be lessening.

- SOL Stabilizes Following Adjustment: Solana trading around the level of 223 shows that there is reduced selling pressure, and the AO indicators are pointing to a new development of a market.

The digital assets are reasserting themselves as the movers in the market as major movers in the market get ready to experience a decisive year. The best opportunities are found in the name of Cardano (ADA), Sui (SUI), and Solana (SOL), which are the most active and have strong technical frameworks. All three exhibit volatility that has improved recently, and they all have indicators of stabilization and possible growth impetus, which makes them leaders in the early 2025 growth cycle.

ADA Posts Stable indications following upsurge.

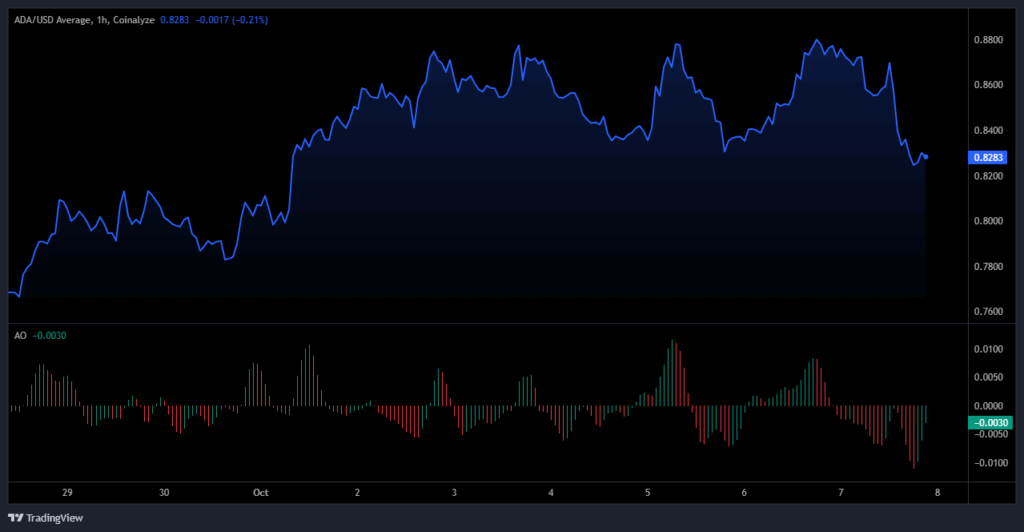

The ADA of Cardano is still showing a high level of resilience because its price is stabilizing between $0.82 and 0.83 following its recent growth. The token had earlier risen by moving upwards between 0.75 and 0.88 which shows steady building of the token. But the pace has slowed down with the Awesome Oscillator (AO) exhibiting flattening action indicating a possibility of short-term consolidation.

Source: Coinalyze

Bullish pressure is being cooled, the recent move towards weaker red bars is a sign of weakening of green AO bars. Nonetheless, ADA has been stable above $0.82, which would indicate a possible reversal in case stability in price is maintained. The breach at this level might result in a retest of $0.85 or 0.86 and this will restore favorable mood among the market participants.

Furthermore, if ADA slips below $0.82, it could test the $0.80 mark before regaining strength. The AO remains near the zero line, suggesting balanced momentum and reduced volatility. With its steady base and low-risk zone, ADA positions itself as a candidate for gradual appreciation in early 2025.

SUI Maintains Downtrend but Nears Potential Reversal Zone

SUI continues to trade under mild downward pressure as price action moves from $3.55 toward $3.46. The short-term decline reflects consistent selling momentum confirmed by negative AO readings. However, recent histogram patterns show smaller bars, suggesting reduced volatility and the potential for stabilization.

Source: Coinalyze

SUI remains below the $3.50 intraday resistance level, keeping the short-term trend slightly bearish. Yet, the decreasing slope of the AO implies that bearish energy could soon fade. A successful reclaim of $3.50 would likely drive a short rebound toward $3.55, marking an early reversal signal.

Conversely, persistent weakness under $3.45 could push price levels closer to $3.40 before recovery attempts emerge. The AO’s subdued movement also suggests the market is entering a neutral stage. Therefore, SUI’s short-term outlook appears corrective but potentially ready for a technical bounce if accumulation grows.

SOL Retests Support with Weakened Selling Momentum

Solana’s SOL continues its retracement from $228 to $223 after consistent pressure across lower timeframes. The AO remains below zero, reflecting sustained bearish sentiment. Yet, flattening red bars on the histogram indicate a slowing pace of selling as volatility compresses.

Source: Coinalyze

Price action around $223 shows repeated stabilization attempts that may precede a minor recovery phase. A move above $225 would signal the first shift in momentum toward short-term balance. For confirmation, AO must cross the zero line and print consecutive green bars, marking renewed positive strength.

If SOL fails to regain $225, sellers may maintain control and retest the $222 area. However, reduced histogram intensity signals exhaustion among short-term participants. With its long-term structure intact, Solana could see renewed traction as broader market conditions stabilize in early 2025.

Market Overview

ADA, SUI, and SOL collectively show measured recovery behavior after a week of volatility and correction. ADA appears the most stable, maintaining key support levels, while SUI and SOL approach potential turning points. Across all three, AO readings indicate momentum cooling and preparation for fresh directional moves.

These assets remain among the most dynamic in the digital asset landscape heading into 2025. Their patterns of consolidation and early recovery suggest growing participation and technical resilience. With favorable setups and controlled volatility, ADA, SUI, and SOL continue to stand out as fast-growing cryptos to watch in the coming year.