- DOT: Connects multiple blockchains, enabling interoperability and scalable Web3 development.

- UNI: Decentralized trading platform with automated liquidity and community governance.

- AAVE: Allows crypto lending and borrowing with innovative features like flash loans.

Decentralized finance continues to change the way people manage money, and certain altcoins are emerging as strong candidates for accumulation in 2026. DOT, UNI, and AAVE each offer unique features that address different aspects of the crypto ecosystem. Polkadot focuses on blockchain interoperability, Uniswap simplifies token trading, and Aave provides lending and borrowing solutions without traditional banks. Understanding what makes these projects stand out can help investors choose coins with long-term potential and practical use cases.

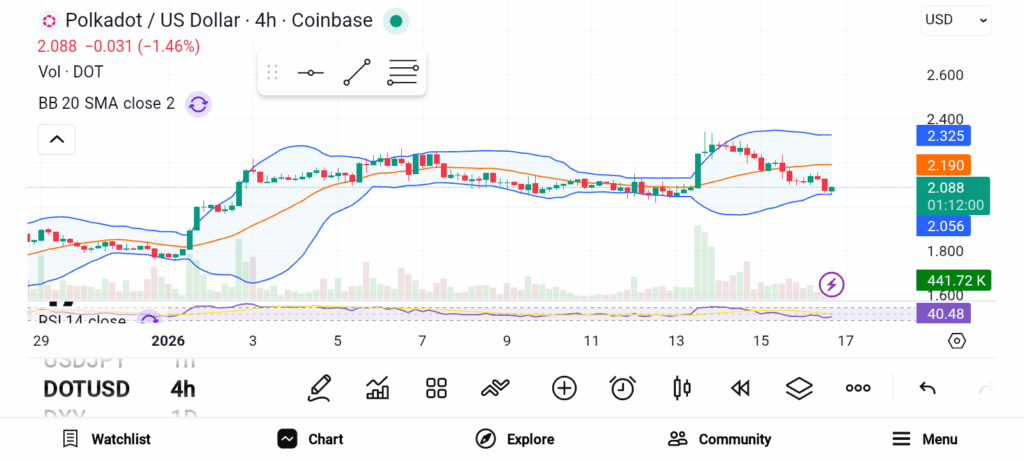

Polkadot (DOT)

Polkadot is designed to connect multiple blockchains and allow them to share data and assets securely. Independent blockchains, called parachains, operate together through a central relay chain, forming a cohesive network. This structure enables developers to build specialized blockchains that can interact seamlessly with one another. DOT tokens serve several purposes, including governance, staking to secure the network, and bonding parachains to the ecosystem. A global community of developers, validators, researchers, and partners supports Polkadot, ensuring ongoing innovation and network security. The focus on interoperability and scalability positions Polkadot as a foundational layer for Web3, making it a strong candidate for long-term growth.

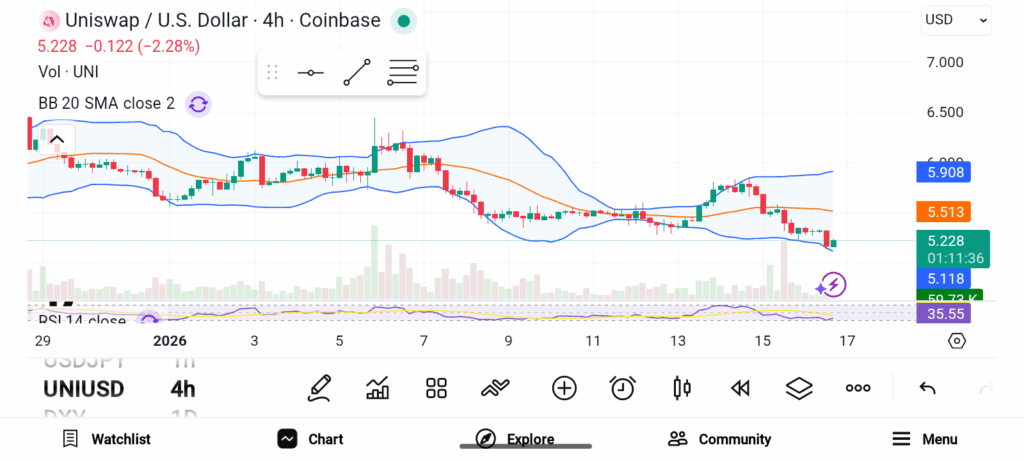

Uniswap (UNI)

Uniswap has become one of the most recognized decentralized trading protocols. The platform uses an automated market maker model, which allows token holders to trade directly without relying on traditional exchanges. By automating liquidity management, Uniswap overcomes challenges that affected earlier decentralized exchanges, making trading more efficient and accessible. UNI token holders participate in governance, allowing the community to influence decisions about the platform’s development and features. Uniswap’s combination of accessibility, automation, and community governance ensures it remains a central hub for decentralized token trading, offering strong potential as adoption continues to grow in the DeFi space.

Aave (AAVE)

Aave provides a decentralized ecosystem for lending and borrowing cryptocurrencies without intermediaries. Users can deposit assets to earn interest or borrow funds using collateral, all within a transparent, non-custodial system. The protocol supports variable and stable interest rates and introduced innovative features like flash loans, which have become popular tools for advanced users. AAVE tokens enable governance, allow staking in the safety module, and help maintain network security. Aave’s global community of developers, liquidity providers, and governance participants strengthens the platform’s reliability and long-term sustainability. Its innovative features and strong user base make it a key player in the DeFi lending market.

Polkadot, Uniswap, and Aave showcase the diversity and potential of decentralized finance. Each project tackles a unique challenge, whether it’s blockchain interoperability, token trading, or lending and borrowing solutions. Strong communities and practical applications enhance their appeal as long-term investments. For investors looking to accumulate DeFi altcoins in 2026, these three projects provide both utility and growth potential within the broader crypto ecosystem.