- Solana: Fast, low-cost transactions and multiple spot ETFs attract both retail and institutional capital.

- Ripple: Spot ETFs and locked supply position XRP to benefit from rising global liquidity.

- Chainlink: Cross-chain infrastructure and tokenization demand make LINK poised for growth with expanding liquidity.

Rising global liquidity often pushes capital into alternative assets, and crypto frequently ranks near the top. Investors look for altcoins with strong infrastructure, growing adoption, and accessible ETFs. Networks that support fast, low-cost transactions and offer institutional exposure tend to attract capital first. Solana, Ripple, and Chainlink stand out in this context. Each project has unique strengths that could draw fresh investment as M2 money supply increases.

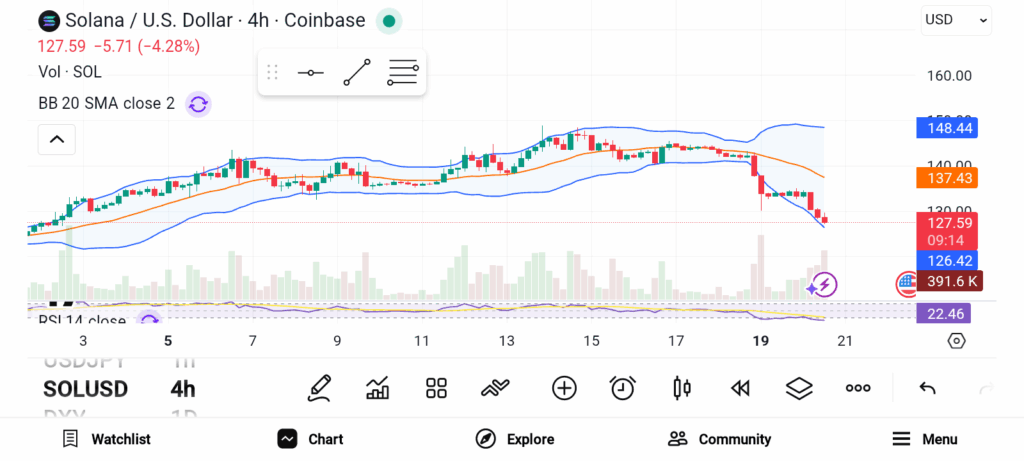

Solana (SOL)

Solana’s SOL has positioned itself as one of the leading altcoins for liquidity-driven gains. Currently, seven SOL spot ETFs operate across different platforms, and two more remain pending approval. The VanEck SOL ETF recently went live, while the Bitwise SOL ETF continues to dominate, managing almost $900 million in assets. Steady inflows throughout December highlight consistent investor interest and confidence in the token.

Beyond ETFs, Solana attracts attention for its fast and low-cost transaction capabilities. These features make the network efficient for both retail and institutional participants looking to move capital quickly. The ecosystem continues to grow, hosting a wide range of decentralized applications, DeFi platforms, and tokenized asset projects. For example, xStocks ranks second on DeFiLlama’s list of tokenized stocks and ETF protocols.

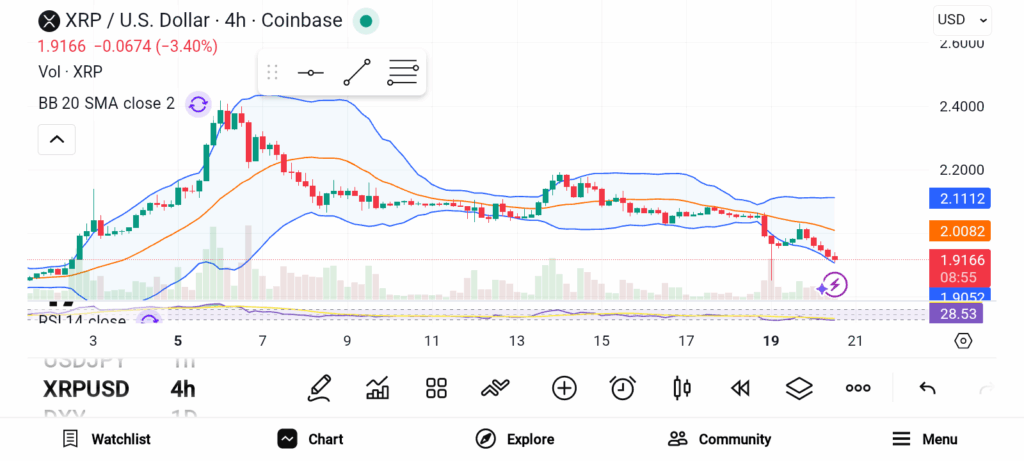

Ripple (XRP)

Ripple’s XRP benefits from multiple spot ETFs, which remain a popular vehicle for investor exposure. Five ETFs currently operate, with three more pending approval. Bitwise manages the largest XRP ETF, and combined ETF assets approach $1 billion. Nearly 478 million XRP sit locked in vaults, roughly 0.47% of the total supply of 100 billion tokens.

XRP’s pre-mined supply presents some risk, as remaining tokens could enter circulation unpredictably. Despite this, historical trends show XRP can benefit from rising liquidity. Charts suggest periods of monetary expansion often coincide with price increases. The combination of ETF exposure, limited circulating supply, and institutional interest positions XRP as a coin that could respond strongly to growing M2 money supply.

Chainlink (LINK)

Chainlink recently launched its first Grayscale LINK spot ETF, which drew $37 million in inflows on its first day. A Bitwise LINK ETF is also expected soon, adding further institutional pathways. Chainlink’s CCIP enables cross-chain communication, connecting over 70 blockchains and creating a wide integration network for developers.

Chainlink also plays a crucial role in tokenization and real-world assets. Major financial players, including BlackRock, increasingly deploy capital through networks like LINK. Oracles support derivatives, DeFi, gaming, and payment applications, making the network highly versatile. As global liquidity expands, demand for Chainlink’s infrastructure may rise sharply.

Solana, Ripple, and Chainlink each stand to benefit from higher global liquidity. ETFs provide a convenient entry point for retail and institutional investors. Fast transactions, strong ecosystems, and growing adoption reinforce their potential. Monitoring these altcoins now may reveal early opportunities as M2 money supply expands.