- A whale liquidated 938,489 LINK tokens across multiple DEXs, realizing a $212,000 profit in 30 days.

- The LINK-to-USDT swaps were executed in structured batches, avoiding price slippage and maintaining market stability.

- All tokens were sold within minutes, confirming a systematic exit strategy with no remaining LINK balance post-sale.

A large cryptocurrency holder has sold 938,489 Chainlink (LINK) tokens worth approximately $21.46 million in a series of transactions completed within minutes. On-chain data confirms the systematic liquidation of the entire LINK portfolio through multiple decentralized exchanges and wallets, resulting in a net profit of around $212,000. The sale marks a complete cycle of accumulation and exit, executed over the course of one month.

Multiple Wallets and DEX Routes Used for Offloading

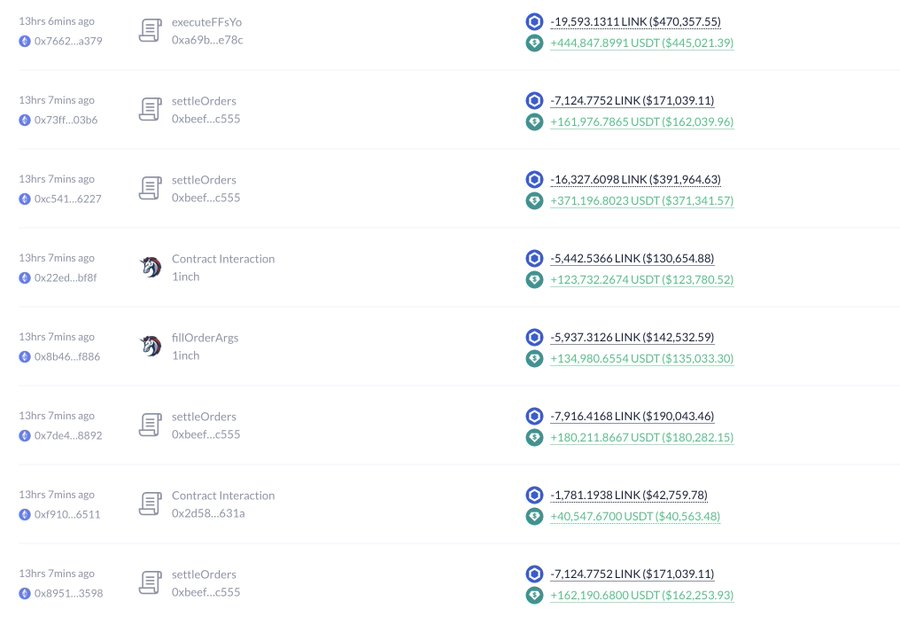

Confirmed by a Lookonchain post on X, the whale executed the LINK-to-USDT trades in separate batches instead of a single bulk sale. Transaction records show the use of multiple wallets and decentralized exchanges, including 1inch. This method allowed the whale to avoid price slippage while liquidating large amounts. The trades varied in size, with most falling between $130,000 and $470,000 per transaction.

One recorded swap involved 19,593.1311 LINK traded for 444,847.8991 USDT, valued at $445,021. Another transaction showed 16,327.6098 LINK exchanged for 371,196.8023 USDT, or $371,341. These trades, along with several others, confirm a deliberate exit strategy rather than a random selloff.

The whale originally acquired the LINK tokens one month earlier, when the average trading price was around $22.87. At that time, the total cost of the investment reached approximately $21.25 million. With the recent liquidation fetching $21.46 million, the realized gain stands at about $212,000. This return reflects a marginal price increase during the 30-day holding period.

Seven Sales Spanning a Few Minutes

Across the exit transactions, several notable swaps occurred within a short time frame. One transaction involved 7,124.7752 LINK exchanged for 161,976.7865 USDT, with a value of $162,039. Another trade saw 5,442.5366 LINK converted into 123,732.2674 USDT. A separate swap moved 5,937.3126 LINK in return for 134,980.6554 USDT. Shortly after, 7,916.4168 LINK was sold for 180,211.8667 USDT.

In another transaction, the whale exchanged 1,781.1938 LINK for 40,547.6700 USDT. A repeated sale of 7,124.7752 LINK followed, generating 162,190.6800 USDT. Each of these trades occurred within minutes of one another. The close timing and consistent trade sizes indicate a structured execution strategy. By breaking the full liquidation into smaller lots, the whale managed price risk while converting LINK holdings into stablecoins without causing major price impact.

After the final trade, the whale’s full LINK position had been successfully converted to stablecoin. There were no remaining balances, and no further activity related to the address has been observed. The trades did not significantly impact LINK’s price but did shift token distribution on-chain. The sale concludes the whale’s one-month strategy of entry and exit, with a complete shift from LINK to stable reserve.